Accounting technologies are changing how work gets done in the accounting profession. From artificial intelligence (AI) and machine learning to cloud computing and automation tools, these solutions help accounting firms save time, reduce human error, and improve financial reporting.

For accounting professionals, this shift means less manual data entry and more time to focus on problem solving and high-value services like tax planning and analyzing financial statements. Whether it’s using cloud-based software for real-time collaboration or robotic process automation to handle rule-based tasks, modern accounting technology is making the accounting world faster, more accurate, and more connected.

What Is Accounting Technology?

Accounting technology refers to the software solutions, tools, and systems that help accounting professionals manage financial data, process financial transactions, and improve the accuracy of financial reporting. It covers everything from cloud-based accounting software to artificial intelligence (AI), data analytics tools, and automation tools that handle routine tasks.

In the accounting world, technology has moved far beyond calculators and spreadsheets. Modern accounting technology can:

- Automatically extract data from receipts, invoices, and tax forms

- Process and store financial statements securely on remote servers

- Enable real-time collaboration between team members and clients

- Reduce manual tasks and manual data entry, lowering the risk of human error

- Help accounting firms generate actionable insights from big data and historical data

This shift is reshaping the future of accounting. Instead of spending hours on time-consuming tasks, today’s accountants can focus on problem solving, advising clients, and using emerging technologies like AI tools, blockchain technology, and robotic process automation to deliver faster, more accurate results.

AI and Machine Learning in Accounting

Artificial intelligence (AI) is the simulation of human intelligence by machines. In the accounting world, AI can mimic human judgment to help with decision-making, detect errors, and speed up work. Machine learning, a subset of AI, allows computers to learn from historical data and improve at automating routine tasks over time.

New technology for accounting firms includes generative AI tools, advanced data analytics platforms, blockchain technology for secure transactions, RPA for repetitive work, and mobile accounting apps for real-time collaboration.

How AI Helps Accounting Firms

AI-powered tools are transforming the accounting profession by removing many time-consuming tasks from an accountant’s day. This includes:

- Automating routine tasks like reconciling financial transactions

- Using optical character recognition (OCR) to automatically extract data from invoices, receipts, and tax forms

- Analyzing vast data sets to find patterns or risks that a manual review might miss

- Predicting the outcome of tax planning cases using past results and critical data

- Summarizing large volumes of financial data with AI tools like ChatGPT to produce actionable insights

AI and Machine Learning Benefits for Accountants

| Benefit | Impact on Accounting |

| Reduced manual data entry | Saves time and lowers human error |

| Faster financial reporting | Speeds up the process to generate reports and close periods |

| Improved problem solving | AI identifies unusual data points and suggests solutions |

| Better decision-making | Data analytics tools help accountants make informed decisions |

| Increased work-life balance | Frees accountants to focus on high-value client work |

The use of AI in accounting is growing fast, projected to rise by 32% year-over-year through 2028. For today’s accountants, understanding how to apply AI and machine learning in daily accounting processes isn’t optional. It’s becoming a standard skill for staying competitive in the future of accounting.

Related: AML Software for Accountants

Cloud Computing for Accounting

Cloud computing lets accountants store and run software applications on remote servers instead of local computers. This means you can access your financial data from anywhere with an internet connection. For accounting firms, this shift has changed how teams collaborate, manage accounting processes, and deliver services.

Why Cloud Technology Matters in the Accounting Industry

- Supports real-time collaboration between team members and clients

- Reduces the need for costly in-office servers and IT infrastructure

- Improves security by keeping critical data in professionally managed cloud-based environments

- Allows accounting professionals to share data instantly and work on financial statements together

- Makes remote work possible for accountants who need flexibility

- Enables seamless integration with automation tools and tax software

- Provides scalability for small businesses and growing firms without big IT budgets

Key Benefits of Cloud-Based Accounting

| Benefit | Impact on Accounting |

| Work from anywhere | Access financial processes from a laptop or mobile devices |

| Lower costs | No need for physical servers or expensive hardware |

| Real-time data access | View and update financial transactions instantly |

| Improved collaboration | Accountants and clients can review, edit, and approve documents together |

| Automation tools integration | Connect with tax software and other apps to reduce manual tasks |

| Faster financial reporting | Close books and generate reports more quickly with real-time data |

| Automatic updates and backups | Ensures you’re always using the latest features while protecting critical data |

| Enhanced security | Encryption, multi-factor authentication, and controlled access safeguard financial data |

| Scalability | Easily add more storage or users as your firm grows |

| Better disaster recovery | Data stored in the cloud is protected from local hardware failures |

Most modern accounting technology is now fully cloud-based. Platforms like QuickBooks Online, Xero, and FreshBooks give small businesses and accounting firms the ability to track project progress, process tax forms, and manage financial reporting without being tied to a desk.

For many in the accounting profession, adopting cloud accounting isn’t just a convenience, it’s a must-have to stay competitive in a fast-moving accounting world.

Related: Digital Transformation in Accounting

Data Analytics and Big Data in Accounting

In the accounting world, numbers have always mattered. But with data analytics and big data, accountants aren’t just reporting what happened, they’re helping shape what happens next.

Instead of simply preparing financial statements, accounting professionals can now dig into vast data sets, uncover hidden patterns, and deliver actionable insights that guide smarter decisions.

What Big Data Really Means

Big data is more than just “a lot of numbers.” It’s years of financial transactions, historical data, and critical data from multiple systems, all combined into one picture. Traditional spreadsheets can’t handle it, but modern accounting technology can.

With data analytics tools, accountants can process data in seconds, highlight unusual trends, and spot data points that a manual review would miss.

Why It Matters for Accountants

Imagine forecasting revenue for the next quarter with high accuracy, catching irregular expenses before they become costly problems, or giving a small business targeted advice on tax planning.

Accountants can also generate real-time data reports, so managers make decisions based on today’s numbers, not last month’s. They can customize insights to fit a client’s industry, goals, and challenges, making their advice more relevant and valuable.

The Shift in the Accounting Profession

What used to be slow, manual, and reactive is now fast, automated, and proactive. By learning how to analyze data and apply it, accountants are moving from record-keepers to trusted advisors.

In the future of accounting, these skills won’t just be an advantage, they’ll be a requirement for staying competitive in a fast-changing accounting industry.

Robotic Process Automation (RPA) in Accounting

Robotic Process Automation (RPA) uses software “robots” to handle rule-based, repetitive tasks in the accounting industry, the kind of work that’s essential but often time-consuming and prone to human error.

How RPA Works in Accounting

RPA tools follow set rules to complete tasks without human input. They can:

- Automatically extract data from invoices, receipts, and tax forms using optical character recognition (OCR)

- Apply bank rules in your accounting software to match transactions instantly

- Auto-publish supplier receipts for faster processing

- Pull financial transactions from different systems and post them to the right accounts

- Automate tax planning steps that follow fixed, predictable rules

Why Accounting Firms Use RPA

- Speed: Automates transaction matching, reconciliations, and other financial processes

- Accuracy: Cuts down on manual data entry, improving financial reporting quality

- Time savings: Gives accountants more room for problem solving, tax planning, and client work

- Scalability: Can be expanded and combined with automation tools and AI for even greater impact

The Value for Accountants

For many accounting firms, RPA is the gateway to more advanced automation strategies. Integrated with artificial intelligence and machine learning, it doesn’t just speed up work, it helps accounting professionals analyze data, find patterns, and deliver actionable insights.

The bottom line? RPA streamlines workflows, improves accuracy, and frees accountants to focus on high-value work, without sacrificing control over quality.

Blockchain Technology in Accounting

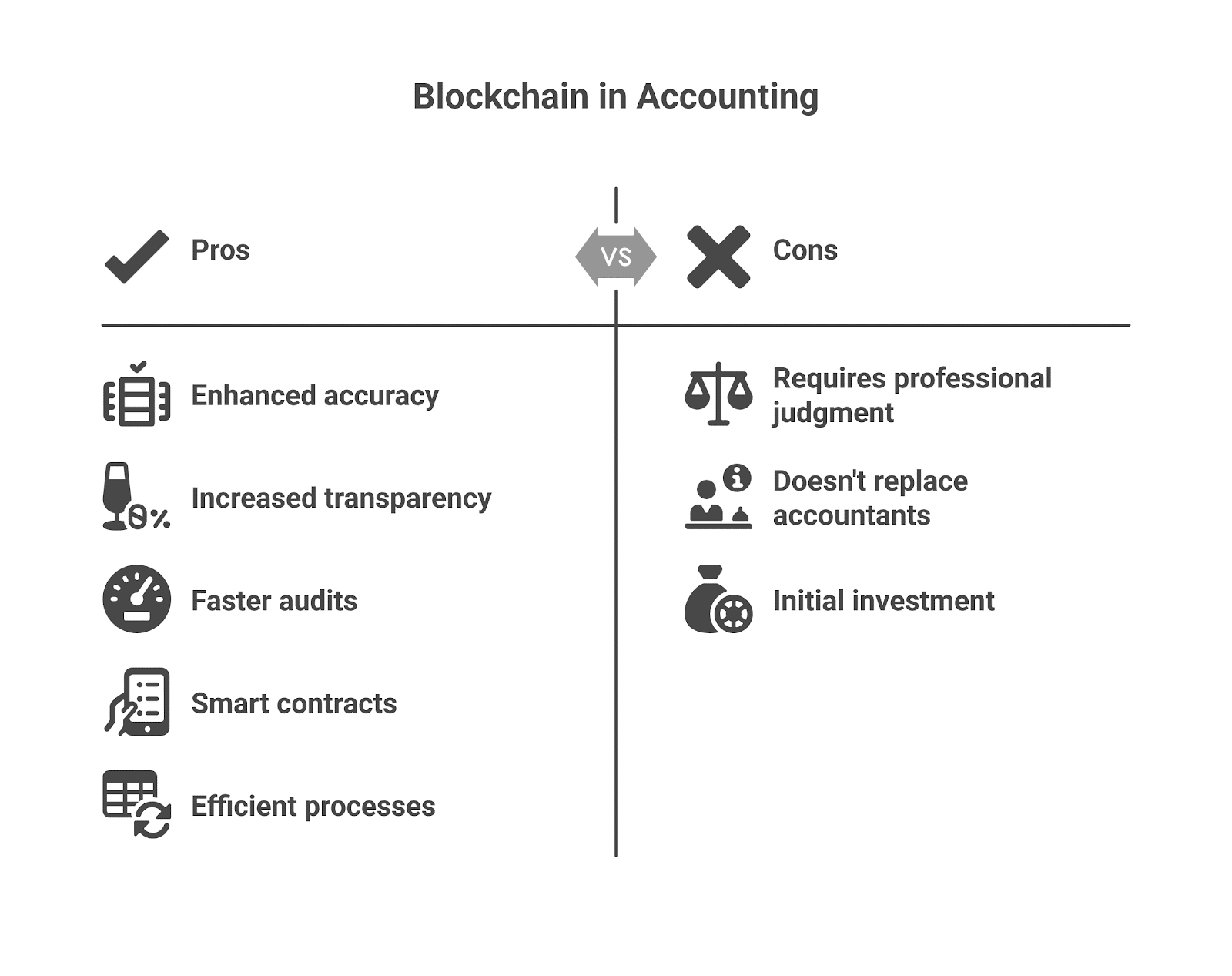

Blockchain technology offers a secure, transparent way to record transactions. Each entry is stored in an immutable ledger, meaning it can’t be altered without leaving a trace. For accounting firms, this improves accuracy in financial records and builds trust in financial reporting.

Blockchain can speed up audits by giving auditors real-time access to verified financial data. It also allows for quick transaction verification and can be used to execute smart contracts, which automatically carry out agreements when set conditions are met.

While blockchain can simplify parts of the audit process, professional judgment is still needed for tasks like transaction classification and estimates. It doesn’t replace the accountant’s role, it enhances it by making financial processes more efficient and secure.

Cybersecurity in Accounting

Strong cybersecurity is essential for protecting sensitive financial data in the accounting profession. Breaches can lead to financial loss, legal issues, and reputational damage for accounting firms.

Effective protection includes multi-factor authentication, encryption, and secure client portals to keep critical data private. Regular employee training helps reduce risks from phishing or weak passwords, while reliable backup systems ensure data can be recovered if compromised.

Regulations like GDPR and CCPA require firms to safeguard client information, and noncompliance can result in heavy fines. Using AI-driven monitoring tools adds another layer of defense, spotting unusual activity in real time to prevent threats before they escalate.

Related: Appointment Scheduling Software

Accounting Software and Automation Tools

Accounting software and automation tools have become essential for improving the speed and accuracy of financial processes. Many of these solutions are cloud-based, giving accountants and clients access to real-time data from anywhere. This not only supports remote work but also allows for real-time collaboration on financial statements and reports.

Automation technology reduces manual data entry and the risk of human error. By integrating software applications through APIs, firms can connect their systems so information flows seamlessly. Tools like optical character recognition (OCR) can automatically extract details from invoices, receipts, and tax forms, while tax software can simplify tax planning and ensure compliance.

Common uses for accounting software and automation tools include:

- Tracking and managing financial transactions

- Automating routine tasks like bank reconciliations

- Using workflow automation to manage repetitive accounting steps

- Connecting systems through APIs to reduce duplicate data entry

- Speeding up tax preparation with specialized tax software

- Using mobile devices to manage tasks from anywhere

By adopting these technologies, accounting firms can streamline their accounting processes, save time, and improve accuracy. This shift frees accounting professionals to focus on higher-value services such as data analysis, business advice, and strategic planning, making them more competitive in the future of accounting.

Frequently Asked Questions

What type of technology is used in accounting?

Accounting uses technologies like artificial intelligence, cloud computing, data analytics, robotic process automation, blockchain, and accounting software to improve accuracy, speed, and security in financial work.

What is an accounting tech?

An accounting tech is a technology, tool, or system, such as cloud-based software or automation tools, that helps accountants manage financial processes more efficiently.

What is the best tech for accountants?

The best tech for accountants includes cloud accounting software (e.g., QuickBooks Online, Xero), data analytics tools, RPA, and AI-powered solutions for automating routine tasks and enhancing financial reporting.

What are the new technology for accounting firms?

New technology for accounting firms includes generative AI tools, advanced data analytics platforms, blockchain technology for secure transactions, RPA for repetitive work, and mobile accounting apps for real-time collaboration.

Conclusion

Accounting technologies are reshaping the accounting profession, making work faster, more accurate, and less dependent on manual tasks. From artificial intelligence and machine learning to cloud computing, data analytics, robotic process automation, blockchain technology, and advanced accounting software, each innovation plays a role in improving efficiency and reducing human error.

Firms that embrace these tools can process financial data in real time, enhance financial reporting, and offer clients more actionable insights. They can also automate routine tasks, protect critical data with stronger security, and adapt more easily to the demands of remote work and the future of accounting.

The message is clear: adopting the right mix of emerging technologies is no longer optional. For accounting professionals who want to remain competitive and deliver higher-value services, technology is the key to smarter decisions, stronger client relationships, and long-term success in the accounting world.