Pricing accounting services can be challenging. Set your fees too low, and you’ll end up overworked with little profit. Set them too high, and clients might leave because they don’t see the value. Many firms still rely on hourly billing, but that model punishes efficiency and limits growth. Clients don’t pay for your time, they pay for outcomes. When you save them time, reduce tax burdens, or improve cash flow, that’s where your real value lies.

Value-based pricing focuses on results instead of hours. It helps position your services as a partnership rather than a commodity. Fixed and hybrid pricing models also bring stability by giving clients clear expectations and helping your firm predict revenue. With fixed fees, you can improve cash flow, reduce billing surprises, and set clear project scopes from the start.

However, even the best pricing model needs structure and communication. To succeed, you must align your fees with the value you deliver and explain that value clearly to clients. The right pricing strategy isn’t just about numbers, it’s about growth, clarity, and building stronger client relationships.

Related: What is Accounting Workflow, Skills Needed to be an Accountant

What’s Going Wrong with Most Accounting Firms’ Pricing Models?

Many accounting firms work hard but earn less than they should. Relying on hourly billing rewards time, not results, and punishes efficiency. The faster you finish a task, the less you make. It also creates burnout and unpredictable income. For clients, hourly pricing feels uncertain, they don’t know the final cost and hesitate to ask questions. That hurts trust and weakens client relationships.

Switching to fixed fee pricing improves transparency and helps firms bill upfront, making cash flow easier to manage. Clients prefer knowing what they’ll pay, and firms can plan revenue better. But fixed pricing has limits. When a client needs to expand without a price change, scope creep cuts into profits. Without a clear engagement letter, firms often over-deliver without fair pay.

The real issue is pricing that doesn’t match value. Whether you use hourly rates, fixed fees, or a value-based pricing model, your prices should reflect the results your accounting and bookkeeping services deliver. When you price accounting services based on outcomes, like better cash flow or smarter tax planning, you stop competing on cost and start earning what your work is worth.

Why Hourly Billing Still Dominates and the Hidden Cost

Many accounting firms still rely on hourly billing because it feels simple and safe. You track time, multiply by your hourly rate, and send an invoice. But while this model looks fair on paper, it quietly limits your profits and damages client relationships.

Why firms keep using hourly billing:

- It’s easy to explain and apply across different services

- It gives a sense of control and transparency, clients see what they’re paying for

- It feels “fair” since longer work equals higher pay

The hidden problems:

- Punishes efficiency: When you automate tasks or complete work faster, you earn less.

- Creates client anxiety: Clients hesitate to ask questions because they fear higher bills.

- Limits growth: Your revenue is capped by the number of hours you can bill.

- Hurts cash flow: You often wait until after work is done to get paid, leaving income unpredictable.

Fixed-Fee Pricing: Better but Not Immune

Fixed-fee pricing solves many of the issues tied to hourly billing. It gives clients cost certainty, improves cash flow through upfront billing, and helps firms forecast revenue. Clients appreciate knowing exactly what they’ll pay, and firms gain efficiency by cutting down on time tracking and disputes.

However, fixed pricing isn’t perfect. When client needs grow without a fee adjustment, scope creep reduces profits. Without clear terms in the engagement letter, firms often provide additional services for free. Many also set prices based on competitors instead of the true value of their work, creating a “race to the bottom.”

To make fixed-fee arrangements work, your pricing strategy must connect fees to value. The best firms now blend fixed pricing with value-based or hybrid models, offering predictable costs while charging fairly for results like better cash flow, financial reporting, or tax planning.

| Pricing Model | How It Works | Client View | Firm Impact |

| Hourly Billing | Pay for time spent | Unclear and unpredictable | Limits profit, discourages efficiency |

| Fixed-Fee Pricing | Set price for defined services | Predictable and transparent | Improves cash flow, risks scope creep |

| Value-Based Pricing | Pay for outcomes delivered | Feels fair and performance-driven | Increases margins, strengthens trust |

| Hybrid Pricing | Mix of fixed, hourly, or value-based depending on service | Flexible and customized | Balances predictability with profitability |

Which Pricing Models Do Accounting Firms Use Today And What Are They Missing?

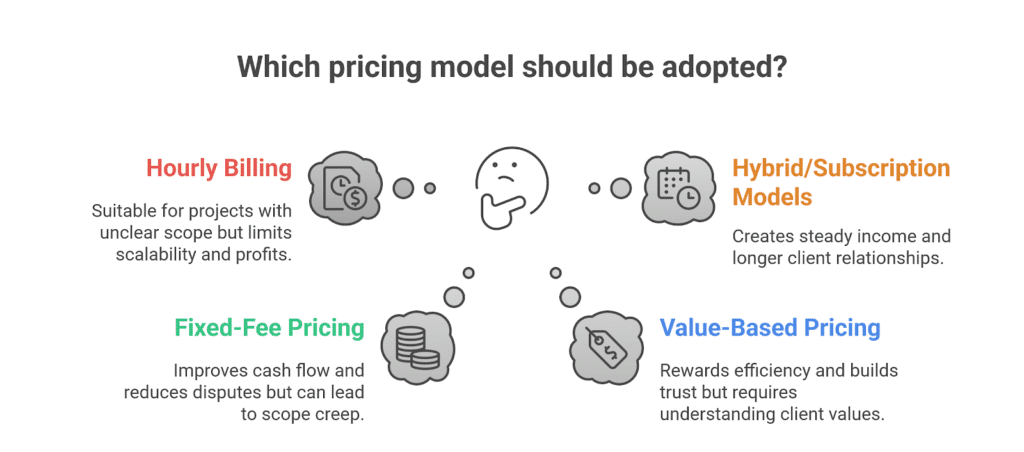

Most accounting firms rely on a few main pricing models, each with its strengths and flaws. Some choose hourly billing because it’s easy to track. Others prefer fixed-fee arrangements for predictability. A growing number now test value-based pricing or hybrid options that mix the best of both.

Common pricing models today:

- Hourly billing: Clients pay for time spent. It works when project scope is unclear but limits scalability and profits.

- Fixed-fee pricing: Firms charge a set amount per service or package. It improves cash flow and reduces billing disputes but can lead to scope creep if not managed carefully.

- Value-based pricing: Fees are tied to results, like better cash flow, stronger financial reporting, or smoother tax planning. This rewards efficiency and builds trust but requires understanding what clients truly value.

- Hybrid and subscription models: Many firms now mix fixed fees with value pricing or offer ongoing monthly plans for bookkeeping and advisory services. These create steady income and longer client relationships.

Recent reports from Ignition show more firms shifting toward value-based and subscription pricing, especially those offering advisory or premium services. These models move the focus from time spent to results achieved, helping firms scale without adding more billable hours.

What Each Model Misses in Terms of Profitability and Growth

No model is perfect. Hourly billing limits growth because it caps earnings at available hours. Fixed pricing improves stability but can shrink margins when scope creep or underpricing happens. Value-based pricing boosts profitability but takes effort, you must define and communicate outcomes clearly.

| Model | Typical Use Case | Pros | Cons | Overlooked Risk |

| Hourly | Projects with unclear scope | Simple, transparent | Punishes efficiency, unpredictable cash flow | Client frustration over surprise bills |

| Fixed-Fee | Recurring tasks like monthly bookkeeping or tax filings | Predictable revenue, easy billing | Risk of scope creep, undervalued outcomes | Underpricing due to weak scoping |

| Value-Based | Advisory services, business or tax planning | Rewards results, builds trust | Harder to set up, needs discovery process | Poor value communication |

| Hybrid / Subscription | Ongoing support and compliance services | Steady revenue, flexibility | Requires clear structure | Over-delivery if scope not defined |

Combining pricing methods works best. A hybrid pricing strategy lets you tailor fees to the services provided, match client expectations, and build a scalable, profitable model that reflects the true value of your firm’s work.

Related: Hierachy of Accounting Positions

How to Choose the Right Pricing Strategy for Your Accounting Firm

Choosing the right pricing model starts with understanding your firm’s size, goals, and the type of services you provide. A solo accountant offering basic bookkeeping will price differently than a mid-sized firm delivering advisory services or tax planning. Your pricing strategy should match your resources, client expectations, and desired level of profitability.

Key factors to assess:

- Firm size and capacity: A small firm may prefer fixed fee billing for simplicity, while larger teams can manage value-based or hybrid models that demand more analysis.

- Service mix: Firms heavy on compliance services (like tax or audit) often use fixed pricing, while those offering advisory or strategy-focused work benefit from value-based pricing.

- Client type: Small businesses expect predictability, while larger clients may prefer flexible pricing options tied to outcomes.

- Efficiency and costs: The more streamlined your operations, the more profitable fixed fees or subscription models become.

- Growth goals: If you’re shifting from basic tasks to strategic advisory, your pricing must evolve to reflect higher perceived value.

Once you’ve reviewed these factors, you can apply a simple framework to identify your best-fit model.

Decision Framework to Guide Your Pricing Model Choice

Use the flow below as a starting point:

- If you’re a solo practitioner with mostly monthly bookkeeping or basic packages, use fixed fee pricing to simplify billing and stabilize cash flow.

- If you’re a small but growing firm automating routine tasks, start testing hybrid pricing, combine fixed fees for compliance with value-based pricing for advisory work.

- If you’re an advisory-first firm serving growth-driven businesses, a value-based pricing approach or subscription model helps you align fees with results and retain high-value clients.

| Firm Type | Recommended Model | Why It Works |

| Solo / Startup | Fixed Fee | Simple, predictable, reduces admin work |

| Small Growth Firm | Hybrid | Balances stability with value-based upsides |

| Advisory-First Firm | Value-Based | Matches pricing to results and perceived value |

The goal isn’t to copy another firm’s structure, it’s to design a pricing strategy that reflects your efficiency, your client relationships, and the value your services bring.

When Is It Time to Shift From Hourly or Fixed-Fee to Value-Based or Hybrid Pricing?

Most accounting firms start with hourly billing or fixed fee pricing because those models feel safe and easy to manage. But there comes a point where they start holding you back. Recognizing when to shift is key to protecting your margins and creating space for growth.

Related: Offshore Accounting, GDPR for Accountants

Signs your firm is ready to change:

- Margin compression: You’re working harder, but profits aren’t growing.

- Client pushback: Clients question your hourly rates or request all-inclusive fees.

- Automation impact: Routine compliance services now take less time, but the value to the client hasn’t changed.

- Demand shift: More clients seek advisory services, they want insights, not hours.

When these signs appear, it’s time to explore value-based or hybrid pricing. These models focus on outcomes rather than time, letting you charge for the impact your services bring, like better cash flow, stronger financial reporting, or smarter business planning.

Transition Roadmap for Your Pricing Shift

Moving away from traditional billing doesn’t happen overnight. You need a plan that protects your revenue while helping clients adapt.

Step 1. Audit your current pricing and costs: Identify which services performed are underpriced or over-delivered.

Step 2. Segment your clients and services.: Group clients by value, size, and complexity. Some may stay on fixed fees, while others are ready for value pricing.

Step 3. Pilot value-based or hybrid pricing: Test your new model with a few trusted clients or a specific service line, like tax planning or monthly bookkeeping.

Step 4. Communicate clearly: Explain how the new pricing reflects outcomes and fairness. Use an updated engagement letter to confirm scope and terms.

90-Day Rollout Checklist

| Timeline | Action | Goal |

| Days 1–30 | Audit pricing, define service scope | Identify gaps and underpriced work |

| Days 31–60 | Test new model with select clients | Gather feedback and measure response |

| Days 61–90 | Roll out changes firm-wide | Align pricing with value, stabilize revenue |

Making the shift requires clear communication and structure, but the payoff is significant, higher profit margins, more loyal clients, and a pricing system that rewards your firm for the results it delivers, not the hours it logs.

How to Quantify the Value You Deliver, So Clients Will Pay More Without Pushback

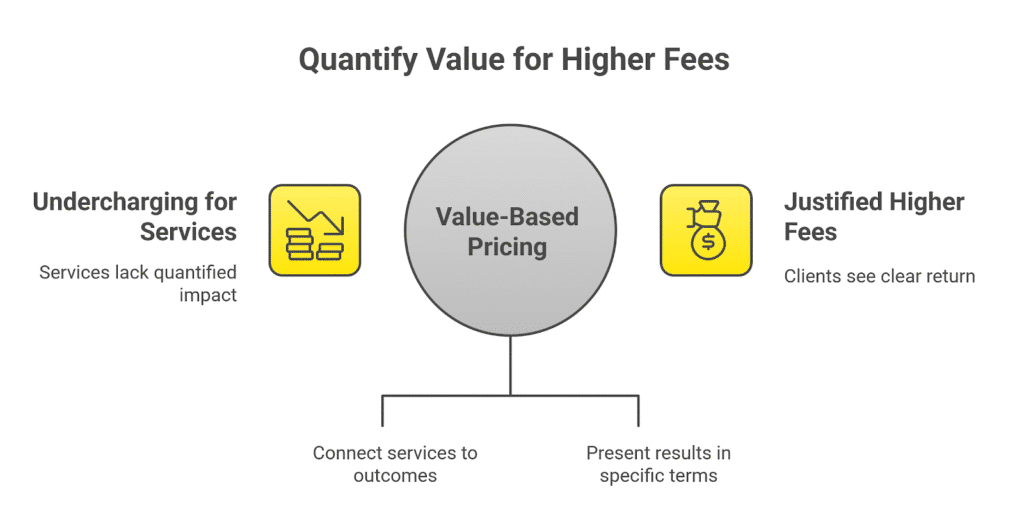

To charge what your work is truly worth, you need to show clients the value you deliver. Most accounting firms undercharge not because their services lack impact, but because they don’t quantify that impact. Value-based pricing only works when clients can clearly see the return on what they’re paying for.

Value isn’t just time saved. It’s what that time creates, stronger cash flow, fewer penalties, smoother tax planning, or better business decisions. Clients care about how your work helps their financial well-being, not how many hours it took. The most successful firms connect every service, whether basic bookkeeping or high-level advisory work, to a measurable client outcome. That’s what builds trust and justifies higher fees.

To make this practical, track and present outcomes in specific terms. Instead of saying “we handle your books,” you could say, “we helped reduce late payments by 20% and improved your cash flow stability.” Numbers like these give clients a clear reason to pay more and stay longer.

Framework and Steps for Quantifying Value

You can turn value into measurable results using a simple three-step framework.

Step 1: Identify client outcomes.

What did your work improve? Examples: reduced tax burden, increased savings, faster reporting, or better cash forecasting.

Step 2: Assign a monetary equivalent.

Translate each outcome into a financial impact. For example, saving a client $5,000 in taxes or freeing up 10 hours of their time each month has real business value.

Step 3: Use it to guide pricing.

Turn these results into a value-based pricing model. Charge according to the impact you create, not the time you spend. This builds fairness and confidence.

| Step | Action | Example of Value |

| Identify outcomes | Define what improved | Reduced tax penalties, improved cash flow |

| Assign value | Estimate dollar impact | $5,000 saved, 10 hours reclaimed |

| Align fees | Price based on results | Premium fee for measurable outcomes |

To make clients comfortable, avoid technical jargon. Use clear, client-focused language. The clearer you communicate value, the more clients understand why your price matches the results your services bring.

How to Package & Present Your Services (Tiers, Menus & Bundles) to Maximise Profit and Client Satisfaction

How you present your pricing can make or break how clients perceive your value. A clear, structured offer helps clients understand what they’re paying for and gives them confidence in your accounting services. Packaging your work into tiers or bundles lets clients self-select based on needs and budget, while positioning you to upsell higher-value options.

Tiered Pricing for Accounting Firms

Tiered pricing works because it simplifies decision-making. Instead of one flat price, you offer clear levels of service, each with increasing value. Most accounting firms use a three-tier setup (often called Bronze, Silver, and Gold) that aligns pricing with service level and client complexity.

Example:

- Basic Package (Bronze): Basic bookkeeping and tax filings for small businesses that want compliance only.

- Growth Package (Silver): Adds monthly bookkeeping, cash flow tracking, and limited advisory services.

- Premium Package (Gold): Includes everything above plus full business planning, tax strategy, and dedicated support.

This approach helps clients choose the right level without negotiation and makes your pricing look structured and transparent. Firms using tiered pricing often see higher conversions and easier conversations around upgrades.

Bundling and Hybrid Models

Bundling groups related services, like compliance, advisory, and automation tools, into one package with a set price. It reduces confusion, avoids scope creep, and makes billing easier. A hybrid model takes this further by mixing fixed fee billing with value-based components. For example, you might charge a flat fee for ongoing bookkeeping and add a performance-based bonus for helping a client meet cash flow or savings goals.

| Packaging Method | Best For | Benefits |

| Tiered Pricing | Firms serving mixed client sizes | Easy to upsell and show value differences |

| Bundled Services | Firms offering recurring compliance services | Simplifies billing, reduces scope creep |

| Hybrid Model | Firms offering both advisory and compliance work | Links price to performance and outcomes |

Structured packaging helps clients see what they’re paying for, while giving your firm flexibility to charge based on value, not just tasks. It turns pricing into a clear, confident part of your brand, not an uncomfortable conversation.

Best Communication Tactics to Raise Fees or Change Pricing Without Losing Clients

Raising fees or changing your pricing model only works when clients understand why. Clear communication keeps trust strong and reduces churn. Clients don’t mind paying more when they see how your accounting services improve their results.

Pricing Psychology & Client Behaviour

Clients value fairness and clarity over low prices. When your pricing strategy is transparent, trust increases. Fixed fee pricing and value-based pricing work well because clients know what they’re paying for.

Using price anchoring, showing options side by side, also helps. When you present tiered packages, most clients pick the middle or premium plan because it feels safer and more complete. Always explain what’s changing and how it benefits them. For example, link higher fees to better cash flow, faster financial reporting, or more proactive advisory services.

Client Messaging & Segmentation

Segment clients before sharing updates. Speak directly to long-term clients and use a short, clear email for others. Be honest about the reason for the change and tie it to results.

Example message:

Subject: Update to Your Service Plan

Hi [Client Name],

We’ve improved how we deliver [specific services], including [key benefit like faster reporting or clearer communication].

To maintain this standard and reflect the value delivered, our service fee will change to [$X] from [date].

This adjustment ensures fair pricing based on outcomes, not hours. Please reach out if you’d like to discuss options.

Kind regards,

[Your Name]

When clients question the change, point to measurable outcomes, like saved time, improved accuracy, or reduced stress. Simple, direct communication shows confidence and keeps client relationships intact while supporting a stronger pricing strategy.

Which Key Metrics Should You Track to Know If Your Pricing Strategy Is Working?

You can’t know if your pricing strategy works unless you track the right numbers. The best accounting firms monitor data that connects pricing to profit and retention.

| Metric | What It Measures | Why It Matters |

| Average Revenue per Client (ARPC) | Income per client | Shows if clients value your services and pay more over time |

| Margin per Service Line | Profit for each service | Reveals which services earn most and which need review |

| % of Value-Based Engagements | Share of work priced by results | Tracks progress away from hourly billing |

| Client Churn / Upgrade Rate | Clients lost or upgraded | Tests if pricing changes affect retention |

| Price Realization Ratio | Billed vs. expected income | Highlights underpricing or scope creep |

5-Question Self-Audit

- Are your margins meeting targets?

- Does pricing match client complexity and value?

- Do clients stay after fee increases?

- How many services still use hourly rates?

- Are client outcomes clearly linked to pricing?

If margins are flat, clients push back on fees, or too many jobs use hourly pricing, it’s time to adjust. The right pricing model should raise profitability, improve cash flow, and align fees with the value your services bring.

Frequently Asked Questions

1. How do you price your accounting services?

You can price your accounting services by aligning fees with the value you deliver, not the time you spend. Most firms use a mix of fixed fee pricing for routine tasks and value-based pricing for advisory work. Start by defining your service scope, estimating client outcomes (like improved cash flow or reduced tax risk), and communicating those results clearly.

2. What is the pricing strategy of accounting firms?

Most accounting firms use one of four models: hourly billing, fixed fee, value-based, or hybrid pricing. The trend is shifting toward value-based pricing, where fees reflect client outcomes instead of time. This approach improves profit margins, builds trust, and better matches modern client expectations for transparency and results.

3. What are the 4 pricing strategies?

The four main pricing strategies for accounting services are:

Hourly billing: Charge for time spent on tasks.

Fixed fee pricing: Charge a set price for defined services.

Value-based pricing: Charge based on client outcomes and perceived value.

Hybrid pricing:Combine fixed and value-based models for flexibility and scalability.

Conclusion

Pricing isn’t just about setting fees, it’s about defining your firm’s value. When you move away from hourly billing and start pricing based on results, your accounting services become more profitable, predictable, and rewarding. You build trust, improve cash flow, and attract clients who see your worth, not just your hours.

But profitability doesn’t stop at pricing. The way your firm looks and communicates online also shapes how clients perceive your value. A dated website or unclear service page can make even great firms look average.

At Ventnor Web Agency, we design modern, high-performing websites tailored for busy accountants who want to stand out, attract better clients, and save time. Let us help you showcase your expertise with a site that works as hard as you do.