If your accounting firm structure feels messy or unclear, you’re not alone. Many firm owners start small and figure things out as they grow. But at some point, the way your team is organized can either help your firm grow or hold it back.

A successful accounting firm structure helps everyone know what to do, who to report to, and how to move client work forward without confusion.

Whether you’re running a small accounting firm with just a few staff accountants or you’re building a medium-sized team with big growth plans, the right accounting firm structure can make your daily work smoother and your future clearer.

In this guide, we’ll walk through seven practical firm structure models to help improve your office operations, client services, and team management. You’ll also learn how firm structure affects financial performance, strategic direction, and your ability to bring in new clients without burning out.

Let’s get started.

Why Accounting Firm Structure Matters

When your team is working hard but not seeing results, the issue is often structure, not effort. How your firm is organized affects everything from workflow speed to communication clarity.

In a small firm, the setup may be simple: the owner manages tax planning and client relationships, an office manager handles admin, and a staff accountant prepares returns and statements. But as your firm grows, this basic structure quickly becomes limiting.

A clear firm structure helps by:

Defining roles and reporting lines

Streamlining team management and client service

Supporting business development and financial goals

Preventing process breakdowns as the firm scales

It also improves the firm owner’s work-life balance by making delegation easier and enabling senior staff to manage operations and client projects.

This matters because:

The owner can focus on strategy and direction

Key projects aren’t delayed or forgotten

Managers and staff know how to contribute effectively

A strong structure also adds stability. It makes it easier to onboard clients, train staff, and adjust to changing demand, without disrupting your workflow.

Traditional vs. Modern Accounting Firm Structures

There’s no one-size-fits-all structure for every accounting firm. But if your current setup feels too slow or too stressful, it might be time to look at how traditional and modern structures compare.

Traditional Accounting Firm Structure (Partner-Led Model)

In a traditional accounting firm structure, the partner is at the center of everything. All work, whether it’s tax planning, financial reporting, or client services, flows through the partner for approval. This setup gives the firm owner full control over quality and decision making, but it often creates a bottleneck.

As more client relationships and accounting tasks pile up, the partner becomes overwhelmed. Many firm owners in this structure find themselves stuck doing day-to-day tasks, reviewing every set of financial statements, and handling all the business development activities alone.

Common Issues with Traditional Structures:

The partner’s workload becomes unmanageable as the firm grows

Client relations may suffer from delays or a lack of attention

New team members wait for approvals, slowing office operations

The firm’s success depends too heavily on one or two people

Modern Accounting Firm Structure (Departmental or Functional Model)

A modern accounting firm structure works more like a corporate business model. The firm is divided into functional areas like client services, tax returns, advisory services, or business development. Each area has its team leaders or senior managers.

This structure allows the firm owner to step back from daily office operations and focus on strategic direction and long-term growth plans.

Benefits of the Modern Structure:

Team leaders handle specialized departments (like tax or client data)

The firm’s managers can make day-to-day decisions without always going to the top

Senior associates and staff accountants know exactly who to report to

The owner can focus on growth, hiring, and improving professional services

Here’s a quick comparison:

| Feature | Traditional Structure | Modern Structure |

| Main decision maker | Firm owner/partner | Shared across departments and managers |

| Team organization | Flat or unclear reporting lines | Department-based with clear roles |

| Scalability | Limited, owner becomes bottleneck | High, teams scale with services and client load |

| Work-life balance for firm owner | Poor, owner stuck in operations | Better, owner focuses on strategic decision making |

| Best suited for | Smaller firms with limited services | Medium-sized or growing firms with multiple departments |

Most successful accounting firm structures today lean toward the modern model, especially when offering advisory services and handling other accounting-related projects. With tools like practice management software and clear management structures, firms can grow without losing control.

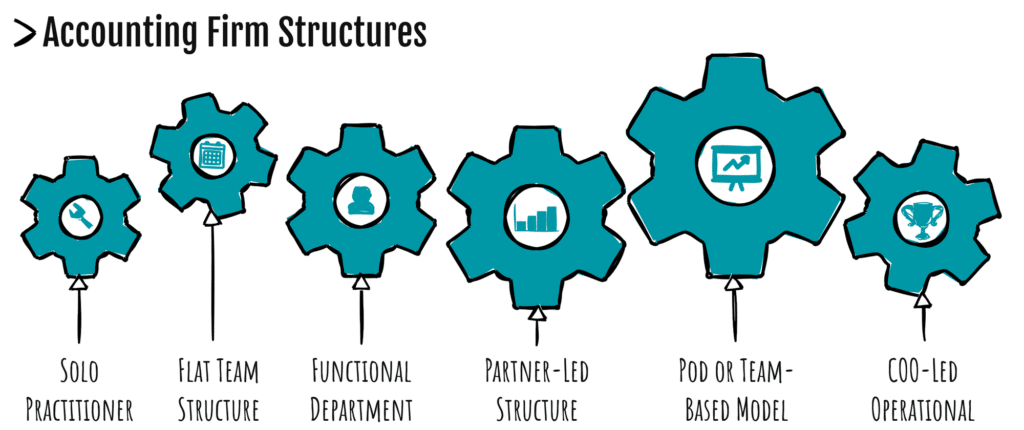

7 Proven Accounting Firm Structure Models

As your accounting practice grows, choosing the right accounting firm structure helps keep your team organized, client services smooth, and your time protected. Below are seven structural models, each with different setups, strengths, and limits depending on firm size and direction.

1. Solo Practitioner with Assistants

This model is ideal for a small accounting firm typically just starting out or run by a single firm owner focused on maintaining a manageable client base. The structure centers on the owner, who handles most accounting tasks such as tax returns, financial statements, and other accounting-related projects. They may work with one administrative staff member or a virtual assistant who supports office operations and handles scheduling or simple client communications.

Pros:

Simple and inexpensive to run

Full control over financial statements and client relationships

Easy to make quick decisions

Strong personal touch with every client

Flexible work hours

Cons:

Heavy workload on the firm owner

Little time for business development

Difficult to take time off

2. Flat Team Structure

A flat team model is best suited for smaller firms with two to five team members. In this structure, the firm owner works side-by-side with staff accountants, while an office manager handles administrative tasks and client data entry. There’s often little formal hierarchy, which makes for fast decision-making but less defined reporting lines.

Pros:

Fast internal communication

Everyone wears multiple hats

Easier to adapt to new client needs

Flexible enough for smaller firms with evolving client needs

Cons:

The owner is still tied to daily tasks

Can get disorganized as the firm grows

Lacks structure for team accountability

3. Functional Department Model

Designed for medium sized accounting firms with around six to fifteen employees, this model divides the firm into functional areas like tax planning, advisory services, client relations, and administrative support. Each function is led by a team leader or senior associate who manages internal processes and oversees junior staff. The firm owner and managers focus on strategic vision while relying on department heads to manage day-to-day operations.

Pros:

Easier to delegate specific accounting tasks

Creates room for team leaders and future firm managers

Supports better financial management and reporting

Aligns with the firm’s strategic direction

Cons:

Needs strong team leaders to succeed

May feel “siloed” if departments don’t communicate

Requires solid practice management software to avoid confusion

Related: Pricing Strategies for Accounting Services, Outsourced Bookkeeping for CPAs

4. Partner-Led Hierarchical Structure

Designed for medium-sized accounting firms with around six to fifteen employees, this model divides the firm into functional areas like tax planning, advisory services, client relations, and administrative support. Each function is led by a team leader or senior associate who manages internal processes and oversees junior staff. The firm owner and managers focus on strategic vision while relying on department heads to manage day-to-day operations.

Pros:

Well-defined roles and responsibilities

Easier to track the firm’s finances and performance

Partners lead their client relationships

Scales well with new hires

More structure for handling complex reporting lines

Cons:

Can slow decision-making if partners are stretched thin

Still depends heavily on senior leadership

May require more meetings and management time

5. Pod or Team-Based Model

This model works well for firms that prioritize strong client relationships and team accountability. The accounting firm is divided into pods, small teams made up of a manager, staff accountants, and support staff, each handling a dedicated group of clients. Each pod functions like a mini firm, handling everything from financial statements to client services independently, with support from shared admin and tech teams.

Pros:

Strong client relationships through consistent contact

Encourages ownership and accountability within teams

Flexible enough to grow by adding new pods

Teams become more invested in client outcomes

Cons:

Inconsistent workflows between pods

Harder to share support staff

Requires high trust among team members

6. COO-Led Operational Model

The COO-led model is a great fit for firm owners who want to step back from day-to-day operations and focus on business development, market demand, or other long-term goals. In this model, a Chief Operating Officer manages the firm’s internal structure, overseeing department heads, handling office operations, and ensuring that administrative tasks and client data are well-managed, while the CEO handles strategy and growth.

Pros:

COO handles day-to-day operations

Free the owner for high-level planning

Strong support for internal processes and team management

Helps retain top talent through defined leadership paths

Cons:

More expensive to hire experienced leadership

Success depends on the COO’s skills and experience

Can feel corporate for smaller firms

7. Modern Corporate Structure

This structure mirrors what you see in large accounting firms, including the big four accounting firms. It’s best for a large accounting firm with multiple departments, each focused on specific professional services like tax planning, advisory, audit, and financial reporting. A CEO leads the organization with a clear management structure that includes department heads, senior associates, and specialized support functions.

Pros:

Matches the business models used by big four accounting firms

Clear lines of authority and team hierarchy

Supports large teams and multiple departments

Best suited for long-term strategic vision

Allows advanced business development systems

Cons:

High complexity in office operations

Requires strong systems, tools, and tech

It can feel impersonal if not managed well

Each firm structure serves a different stage of growth. A small accounting firm typically starts simple but will need more structure as client needs and team size increase. Whether you lead a few staff accountants or manage multiple departments, choosing the right accounting firm structure helps protect your time, improve decision-making, and keep your accounting practice moving in the right direction.

Accounting Firm Organizational Hierarchies by Size

As your accounting firm grows, your internal structure needs to grow with it. What works for a two-person team won’t work for a team of twenty. That’s why setting up a clear organizational hierarchy is so important. It helps everyone understand their roles, improves team communication, and ensures that day-to-day tasks don’t slip through the cracks.

Small Accounting Firm

In a small accounting firm, the firm owner is usually at the top and wears several hats. You might be reviewing tax returns, managing client relationships, and leading business development, all while keeping an eye on the firm’s finances.

You may also have an office manager handling admin work like invoicing and scheduling, and one or two staff accountants preparing tax returns and financial statements. Everyone chips in wherever needed.

This flexible setup works well at first, but it can become overwhelming as client needs grow and support functions start to pile up.

Medium-Sized Accounting Firm

Once your firm grows past five or six people, it needs more structure. Medium-sized accounting firms usually add partners or senior managers to help lead different areas of the business. These might include departments like tax planning, advisory services, and client services.

Each department often has its own manager or team leader. These managers oversee the work of staff accountants and ensure that reporting lines are clear.

You’ll also have an office manager taking care of internal processes, keeping things organized behind the scenes. This type of structure makes it easier to scale, take on new clients, and improve the firm’s financial performance.

Large Accounting Firm

In a large accounting firm, the structure becomes more layered and specialized. You might have a CEO or managing partner setting the strategic direction, while department heads lead specific areas like tax, audit, advisory, or business development.

Senior managers and team leaders take responsibility for overseeing projects, managing client data, and guiding junior staff. Office operations are usually handled by one or more office managers and administrative staff, making sure everything runs smoothly on the back end.

This type of setup is similar to what you’ll find in the Big Four accounting firms. It’s built to handle multiple departments, large client accounts, and a wide range of professional services, all while maintaining strong internal systems and workflows.

A successful accounting firm structure isn’t just about titles; it’s about clarity. As your accounting practice grows, each team member should know exactly where they fit in and what they’re responsible for. That’s how you build a firm that works, even when you’re not in the room.

Best Practices for Designing Your Firm’s Structure

A well-planned accounting firm structure makes everything easier, from managing client work to hiring new staff. But building the right structure doesn’t happen by accident. Whether you run a small team or a growing accounting practice, these best practices will help your firm stay organized, efficient, and ready for growth.

1. Match Your Structure to Your Firm’s Goals

Your organizational structure should support your firm’s mission, services, and growth plans. Want to focus more on advisory services? Then your structure needs space for that, whether that means hiring new team leaders or shifting your current team’s roles.

2. Clearly Define Every Role

Confusion kills productivity. Make sure each person knows their role, who they report to, and what’s expected of them. This is especially important in medium sized accounting firms where partners, senior managers, and staff all work across different client services.

Use this simple breakdown:

| Role | Key Responsibility |

| Firm Owner | Strategic direction and business development |

| Partners / Managers | Oversee departments and client relationships |

| Staff Accountants | Handle accounting tasks and tax returns |

| Office Manager | Run office operations and support functions |

Document these roles. Share them. Review them often.

3. Use Practice Management Software

You don’t need to manage everything with spreadsheets and sticky notes. Tools like Jetpack Workflow, Karbon, or Canopy help your team:

Track client data and deadlines

Manage internal processes and workloads

Streamline communication between staff, partners, and departments

The right software strengthens your management structure and helps you stay on top of financial reporting, tax planning, and other accounting related projects.

4. Review and Adjust As You Grow

Your firm’s structure should never be set in stone. As new clients come in, services shift, or the market changes, your structure should shift too. Build in time, once or twice a year, to review:

Team performance and workloads

Reporting lines and responsibilities

Gaps in client services or support staff coverage

Whether your current business structure still fits your goals

Related: Offshore Accounting, GDPR for Accountants

5. Make Room for Specialization

As your accounting practice grows, specialized roles become more important. Having team members focused on tax planning, advisory services, or even just onboarding new clients improves service and builds expertise.

6. Keep Communication Clear

No matter how good your structure looks on paper, it only works if people know how to communicate. Create simple communication rules:

Who sends updates to the firm’s managers?

How do support staff share client issues?

What does the office manager handle directly vs. escalate?

Strong communication creates a more collaborative environment and reduces mistakes in day to day operations.

7. Create Career Paths That Keep People Long-Term

Accounting professionals want to grow. Define clear paths from staff accountant to team leader or partner. This helps you retain top talent, reduce turnover, and keep your team motivated.

No matter your firm’s size, a strong structure is the foundation of everything else, client experience, financial performance, and your own work-life balance.

How Firm Structure Impacts Work-Life Balance

The way your accounting firm is structured doesn’t just affect tasks, it affects your time, energy, and stress level. Many firm owners find themselves overworked, not because they lack help, but because their firm structure keeps everything flowing back to them.

A successful accounting firm structure supports the business and the people inside it.

Traditional Structure = Owner Overload

In a traditional accounting firm structure, the firm owner or partner handles almost everything:

Reviewing all tax returns and financial statements

Managing client relationships

Solving staff problems

Making every decision

This leaves little time for business development, strategic planning, or rest. As the firm grows, the stress grows too, until the owner burns out.

Modern Structure = Shared Responsibility

A modern firm structure spreads the load. Department managers, senior associates, and team leaders each take ownership of part of the business. The firm owner can finally step back from day to day operations and focus on higher-level goals.

Here’s what this can look like:

| Structure Style | Firm Owner’s Role | Work-Life Impact |

| Traditional | Does everything | Long hours, high stress, little personal time |

| Modern / Team-Based | Delegates to managers and team leads | More time for strategy, family, and health |

| COO-Led Model | Focuses on growth while COO runs operations | Best for scaling and protecting lifestyle |

Hiring Early Helps

Hiring experienced team members, like a COO, office manager, or department head, earlier than you think can give you breathing room. You don’t need to wait until the workload is crushing.

Defined Roles Reduce Stress Firm-Wide

It’s not just the owner who feels it. Poor structure affects everyone. Without clear reporting lines, support staff and accountants get stuck waiting, second-guessing, or repeating work. That leads to frustration and burnout across the team.

When roles and responsibilities are clear, communication is smoother, tasks get done faster, and people feel less overwhelmed.

Related: Accounting Busy Season

Frequently Asked Questions

What is the organizational structure of an accounting firm?

It’s how roles and responsibilities are set up to manage clients, team tasks, and office workflows.

What is the best structure for an accounting firm?

The best structure is one with clear departments and team leads so the owner isn’t stuck doing everything.

What is the Big 4 accounting structure?

The Big 4 use a layered, partner-led model with separate teams for tax, audit, advisory, and admin.

What is the hierarchy in accounting?

Most firms follow a top-down structure with the owner or partners at the top, followed by managers, accountants, and admin staff.

Conclusion

The structure of your accounting firm affects everything, how work gets done, how your team performs, and how much time you have to actually lead.

As your firm grows, your structure has to grow with it. Whether you’re just starting out or managing multiple departments, building the right accounting firm structure can improve your workflow, strengthen client relationships, and give you the freedom to focus on what matters most. The key is to keep it clear, flexible, and aligned with where you want your firm to go.

If your website isn’t supporting that vision, we can help. At Ventnor Web Agency, we build high-converting websites for accounting firms ready to grow and attract better clients. Visit ventnor web agency to see how we can support your next step.