Accounts receivable automation utilises an automated system to streamline the accounts receivable process, encompassing invoicing, payment collection, and cash application. It replaces manual processes and manual data entry, cutting human error and improving cash flow management.

Many businesses still depend on manual accounts receivable processes, which slow down the invoicing process, cause delayed payments, and increase invoice disputes. PYMNTS research found that 86% of firms say manual AR tasks delay their ability to collect payment, leading to more outstanding invoices and overdue payments.

To fix this, companies adopt accounts receivable automation software. These tools send automated payment reminders, support multiple payment options, and provide customer portals for online payments. The result: faster payments, fewer unpaid invoices, and stronger customer relationships.

Firms using AR automation solutions report lower days sales outstanding (DSO), better payment tracking, and more reliable cash flow.

This guide explains:

- What receivable automation is.

- How accounts receivable automation works with existing accounting software.

- The main AR automation benefits.

- Types of accounts receivable software.

- Best practices to improve cash flow and strengthen customer relationships.

What Is Accounts Receivable Automation?

Accounts receivable automation (AR automation) refers to the use of specialised software to streamline and automate manual tasks within the accounts receivable process. It manages the steps of the invoice-to-cash cycle, including the invoicing process, payment collection, cash application, and reporting, through an automated system instead of manual intervention.

With AR automation software, businesses can:

- Generate invoices in formats that match customer payment process rules.

- Send automated reminders for unpaid invoices and overdue payments.

- Support multiple payment channels (ACH, credit card, digital wallets).

- Track the status of outstanding invoices in real time.

- Reduce human error in the payment collection process.

The core AR processes, invoicing, collections, reconciliation, and reporting, remain the same. The difference is that receivable automation replaces manual data entry with smart, automated systems that accelerate and simplify the work.

Manual AR vs Automated AR

Manual AR relies on staff creating invoices, sending payment reminders, and applying payments by hand. This often leads to delayed payments, human error, and more outstanding invoices.

Automated AR, on the other hand, uses accounts receivable automation software to handle these tasks. It ensures timely payments, reduces manual intervention, and gives real-time visibility into the entire accounts receivable process.

| Process Step | Manual Accounts Receivable Processes | Accounts Receivable Automation Work |

| Invoicing | Created manually; risk of errors and format mismatches | Automatically generated; matches customer AP requirements |

| Payment Reminders | Sent individually; often late or inconsistent | Automated reminders scheduled for due and overdue invoices |

| Cash Application | Manual matching of payments to invoices; time-consuming | Payments auto-matched to correct invoices; faster reconciliation |

| Payment Options | Limited (checks, wires) | Multiple payment methods including online payments |

| Tracking & Reporting | Delayed updates; hard to forecast cash flow | Real-time reporting and payment tracking |

| Customer Relationships | Errors and delays cause disputes and late fees | Accuracy improves customer satisfaction and relationships |

How Accounts Receivable Automation Works

The accounts receivable process has always followed the same steps: create invoices, send them to customers, collect payments, apply cash, and reconcile accounts. With manual processes, each step requires time, paperwork, and manual data entry. With accounts receivable automation (AR automation), the steps stay the same, but the work is handled by an automated system.

Here’s how accounts receivable automation works in practice:

Invoicing Process

- Manual accounts receivable processes: Invoices are created by staff, often with errors or missing details. Mistakes here lead to invoice disputes and delayed payments.

- Receivable automation software: Invoices are generated automatically in formats that match customer payment process requirements. They can be sent digitally, reducing delays and manual intervention.

Related: Appointment Scheduling Software, AML Software for Accountants

Automated Customer Communications

- Automated reminders are sent before due dates, on due dates, and after overdue invoices.

- Messages are personalized based on customer behavior, helping businesses collect payment without straining customer relationships.

- This consistency lowers unpaid invoices and increases timely payments.

Payment Collection

- Customers can pay through multiple payment options and multiple payment channels, credit cards, ACH transfers, or online payments.

- Offering flexible payment options makes it easier to accelerate payments and improve the customer payment experience.

- Providing more ways to pay strengthens customer relationships and reduces overdue payments.

- Faster payment collection improves cash flow management across the business.

Cash Application

- Manual processes: Staff manually match checks or transfers with invoices. This is slow, prone to human error, and delays reconciliation.

- AR automation software: The system auto-matches payments to the right invoices, even across multiple payment methods. This speeds up reconciliation and keeps cash flow management accurate.

- Reduces manual intervention and ensures better tracking of outstanding invoices.

Real-Time Reporting

- Automated systems provide live dashboards showing outstanding invoices, overdue payments, and payment tracking.

- Finance teams can spot trends like late payments or use data to offer early payment discounts.

- This improves credit management and gives leaders visibility into the entire invoice to cash cycle.

- Leaders gain visibility into the entire invoice to cash cycle.

- Businesses can forecast cash flow with greater accuracy.

AI and Advanced Features

- More companies are using AI-powered AR automation solutions.

- AI can predict which customers are likely to make late payments, recommend the best payment reminders, and even flag risky accounts for credit management.

- This makes the payment collection process smarter, not just faster.

- Predictive insights help finance teams refine their receivable management strategies.

Benefits of Accounts Receivable Automation

Moving from manual accounts receivable processes to accounts receivable automation software creates clear financial and operational gains. Here are the main AR automation benefits for businesses.

1. Faster Payments and Lower DSO

One of the biggest benefits of automating accounts receivable is faster collections. Automated reminders ensure customers don’t forget their bills, while multiple payment methods, such as ACH, cards, and online payments, make it easier for them to pay quickly. This reduces days sales outstanding (DSO) and shortens the invoice to cash cycle, directly improving a business’s cash flow.

2. Reduced Errors and Disputes

Manual data entry is prone to mistakes, which can lead to invoice disputes, delayed payments, and unhappy customers. By using accounts receivable automation software, businesses can generate consistent invoices, reduce manual intervention, and avoid common human error. The result is fewer disputes, fewer unpaid invoices, and a smoother payment collection process.

3. Improved Customer Relationships

Customers value clarity, flexibility, and consistency when it comes to billing. With automated payment reminders, accurate invoices, and flexible payment options, businesses can deliver a better customer payment experience. This level of transparency not only reduces disputes but also helps strengthen long-term customer relationships and improves overall customer satisfaction.

4. Better Cash Flow Management

Strong cash flow management depends on accurate and timely information. With accounts receivable automation work, finance teams can view outstanding invoices, track late payments, and even offer early payment discounts to encourage faster collections. These real-time insights make it easier to forecast, plan, and ensure healthier business’s cash flow.

5. More Efficient Finance Teams

Finance staff often waste hours on repetitive manual accounting tasks like chasing late payments or reconciling records. AR automation solutions remove much of this low-value work, allowing teams to focus on strategic areas such as credit management and planning. Research from Deloitte shows automation can cut finance costs by up to 40%, proving the value of replacing manual processes with smarter tools.

6. Stronger Credit Management

Effective accounts receivable management isn’t only about getting paid on time; it’s also about managing credit risk. Receivable automation software can analyze customer behavior, flag risky accounts, and adjust credit policies accordingly. This helps reduce exposure to overdue payments and ensures businesses stay ahead in managing their receivable risk.

7. Flexible Payment Experiences

Customers today expect choices in how they pay. AR automation software enables multiple payment channels and customer portals that allow buyers to view invoices, make online payments, and track balances easily. By offering flexible payment options, businesses can accelerate payments, reduce outstanding invoices, and create a smoother customer payment process.

8. Stronger Compliance and Audit Control

Compliance is critical in financial operations, and receivable automation software makes it easier to meet standards. Every transaction is tracked automatically, creating a clear audit trail that integrates with existing accounting software. This reduces reporting errors, speeds up audits, and provides stronger documentation to resolve disputes quickly.

Related: Accounting Technologies: Complete Guide to Modern Tools

Common AR Challenges (and How Automation Solves Them)

Relying on manual accounts receivable processes creates problems that slow down collections, increase costs, and hurt cash flow management. Below are eight of the most common challenges businesses face and how accounts receivable automation software solves them.

Table: Manual AR Challenges vs AR Automation Solutions

| Challenge | Impact of Manual Processes | How AR Automation Solves It |

| 1. Manual Bottlenecks | Hours spent on manual data entry, invoice prep, and follow-ups slow the invoice-to-cash cycle. | Automated systems create invoices, send automated reminders, and track payments instantly. |

| 2. Delayed and Late Payments | Overdue invoices and late payments weaken a business’s cash flow and limit growth. | Automated payment reminders and multiple payment options encourage timely payments. |

| 3. Inaccurate Invoicing & Human Error | Errors in the invoicing process cause invoice disputes, unpaid invoices, and poor customer relationships. | Automation reduces human error by generating invoices directly from accounting systems. |

| 4. Ineffective Collections | Reminders are inconsistent, collectors lack insight into customer behavior, and outstanding invoices pile up. | Receivable automation software segments customers, improves credit management, and sends scheduled reminders. |

| 5. Poor Visibility | Manual reporting hides real-time data on unpaid invoices, payment tracking, and late payments. | AR automation solutions provide live dashboards for cash flow, payment collection, and KPIs like days sales outstanding (DSO). |

| 6. Limited Payment Options | Customers are restricted to checks or wires, delaying the payment collection process. | AR automation software supports multiple payment methods (ACH, card, wallets, online payments). |

| 7. High Collection Costs | Teams waste time on low-value manual accounting tasks instead of strategy. | Automation lowers costs by cutting manual intervention, letting staff focus on credit management. |

| 8. Weak Customer Experience | Errors, late reminders, and slow processes damage customer satisfaction and relationships. | Automated reminders, clear billing, and flexible payment options help strengthen customer relationships. |

Choosing the Right AR Automation Software

Not every accounts receivable automation solution is the same. The right choice depends on how well the tool supports your accounts receivable processes, fits into your existing accounting systems, and helps your business improve cash flow. Below are the most important features to look for when evaluating AR automation software.

| Feature / Capability | Why It Matters |

| Integration with Accounting Systems | Connects directly with existing accounting software to reduce manual data entry and sync invoices, payments, and reports. |

| Automated Invoicing | Creates and delivers invoices in the right format for each customer’s billing system; ensures fewer invoice disputes. |

| Automated Reminders | Sends automated payment reminders on schedule to cut down on overdue invoices and ensure timely payments. |

| Multiple Payment Options | Supports multiple payment methods (ACH, card, wallets, bank transfers) for faster, easier payment collection. |

| Cash Application Automation | Matches customer payments to invoices automatically, reducing human error and speeding up reconciliation. |

| Customer Portals | Gives customers 24/7 access to view outstanding invoices, make online payments, and track their payment status. |

| Real-Time Reporting & Tracking | Offers dashboards for DSO, overdue payments, unpaid invoices, and other key accounts receivable management metrics. |

| Credit Management Tools | Tracks customer behavior, manages credit limits, and reduces risk in the payment collection process. |

| Cloud-Based Access | Allows teams to manage the entire collections process from anywhere, with secure logins and role-based access. |

| User-Friendly Interface | Simple design that reduces training time and makes it easy for finance teams without technical backgrounds to use the system. |

Tips for Selecting the Best AR Automation Solution

- Make sure the tool can embed into your existing accounting systems without heavy customization.

- Compare features vs. pricing to avoid paying for extras you don’t need.

- Look for flexible payment options to improve the customer payment process.

- Choose a system that scales with your growth and supports global invoicing formats if you sell internationally.

- Ensure the software supports early payment discounts and reporting that helps you improve cash flow.

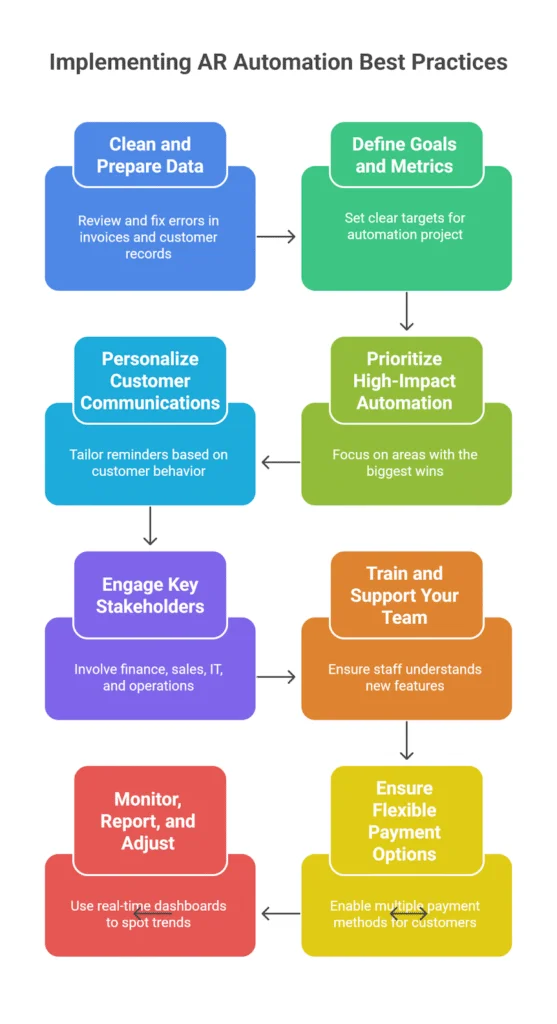

Implementing AR Automation: Best Practices

Switching from manual accounts receivable processes to an AR automation solution requires planning. The goal is not just to install new accounts receivable software, but to improve the entire payment collection process, reduce manual intervention, and strengthen customer relationships.

1. Clean and Prepare Your Data

Before moving from manual processes to an automated system, review all outstanding invoices and customer records. Fix errors in the invoicing process now, otherwise they’ll carry over into your new receivable automation software. Clean data reduces future invoice disputes and ensures smooth payment tracking.

2. Define Goals and Metrics

Set clear targets for your automation project. Common ones include:

- Lowering days sales outstanding (DSO)

- Cutting the number of overdue invoices

- Increasing timely payments

- Improving overall business’s cash flow

Tracking progress against these metrics helps you measure the real AR automation benefits.

3. Prioritize High-Impact Automation

Not every step in the accounts receivable process needs automation at once. Start with areas that bring the biggest wins:

- Automated payment reminders to reduce late payments

- Cash application to remove manual data entry

- Multiple payment options (ACH, card, wallets, online payments) to accelerate payments

These changes improve the payment collection process quickly while proving value to stakeholders.

4. Personalize Customer Communications

A one-size-fits-all approach doesn’t work. Use ar automation software to tailor automated reminders based on customer behavior. For reliable customers, send gentle nudges; for accounts with frequent unpaid invoices, tighten schedules. Personalized communication helps maintain customer satisfaction while still improving collections.

5. Engage Key Stakeholders

Bring finance, sales, IT, and operations into the project from the start. Involving all stakeholders ensures the AR automation solution integrates smoothly with existing accounting systems.

6. Train and Support Your Team

Staff must understand how to use features like customer portals, automated payment reminders, and real-time reporting. Training reduces resistance to change and helps teams fully replace manual accounting tasks.

7. Ensure Flexible Payment Options

Make it easy for customers to pay by enabling multiple payment methods such as ACH, card, or online payments. Flexible payment options improve customer satisfaction and help ensure timely payments.

8. Monitor, Report, and Adjust

The best systems provide real-time dashboards for payment collection, unpaid invoices, and credit management. Use these tools to spot trends:

- Offer early payment discounts if customers consistently delay.

- Adjust reminder frequency if overdue payments rise.

- Track whether automation is reducing manual intervention and staff workload.

Constant monitoring ensures the software continues to improve your entire collections process.

The Future of Accounts Receivable Automation

The role of accounts receivable automation is expanding. What started as tools for sending invoices and automated payment reminders is now shaping the future of cash flow management and customer relationships. Here are the key trends to watch:

1. AI-Driven Collections

Artificial intelligence will play a bigger role in the accounts receivable process. AR systems are already analyzing customer behavior to predict late payments and suggest the best time to send automated reminders. AI will make credit management more precise and help businesses avoid overdue invoices before they happen.

2. Real-Time Cash Visibility

Future AR automation solutions will provide finance teams with up-to-the-minute dashboards that show outstanding invoices, unpaid invoices, and payment tracking across all payment channels. This level of transparency helps businesses act quickly to improve cash flow and plan around real data instead of waiting for end-of-month reports.

3. Customer-Centric Portals

Customer portals will become standard in receivable automation software. Instead of sending checks or calling finance teams, customers will log in, see their outstanding invoices, choose from multiple payment methods, and complete online payments instantly. This shift not only accelerates payments but also improves customer satisfaction.

4. Global Payment Flexibility

As more companies sell internationally, AR tools will support multiple payment options in different currencies and formats. Automated invoicing will adjust to local billing system requirements, while accounts receivable software will streamline payment collection across global markets.

5. End-to-End Automation

Many businesses will adopt full invoice to cash cycle automation. This means invoices, payment reminders, cash application, reconciliation, and reporting will all run with minimal manual intervention. Finance teams will spend less time on manual accounting tasks and more time analyzing ar automation benefits to guide growth.

6. Stronger Compliance and Security

With growing regulations around finance and data, accounts receivable automation software will include built-in compliance checks, audit trails, and secure payment processing to reduce risk and protect sensitive information.

7. Deeper ERP and CRM Integration

AR automation software will integrate more tightly with accounting systems and CRM tools, giving businesses a full picture of both financial and customer data. This helps align the payment collection process with sales and service teams.

8. Predictive Cash Flow Forecasting

Future systems will use automation and AI to forecast cash flow based on patterns in customer payment behavior, overdue payments, and early payment discounts. This allows businesses to make faster, data-driven decisions.

Frequently Asked Questions

Can you automate accounts receivable?

Yes. Businesses can use accounts receivable automation software to handle the full accounts receivable process, including invoicing, payment reminders, cash application, and reporting. Automating accounts receivable reduces manual data entry, lowers errors, speeds up the payment collection process, and improves cash flow management by ensuring more timely payments.

What is the AR automation process?

The AR automation process replaces manual accounts receivable processes with an automated system. Steps include generating invoices, sending automated payment reminders, collecting through multiple payment methods, matching payments to invoices (cash application), and updating reports. This automation streamlines the invoice to cash cycle, reduces manual intervention, and improves accounts receivable management.

Will AI replace accounts receivable?

AI won’t replace the accounts receivable department, but it will transform it. AI in AR automation solutions can predict late payments, optimize automated reminders, and improve credit management. Instead of replacing people, AI reduces manual accounting tasks so finance teams can focus on strategy, analysis, and strengthening customer relationships.

How much does AR automation cost?

The cost of accounts receivable automation software varies by provider, features, and company size. Small businesses may pay $200–$500 per month for basic tools, while enterprise-level ar automation solutions can range from $1,000 to $5,000 monthly. Although costs differ, most companies save money by reducing manual processes and accelerating payment collection.

Conclusion

Accounts receivable automation is no longer optional. Replacing manual accounts receivable processes with an automated system helps businesses send accurate invoices, schedule automated payment reminders, support multiple payment options, and speed up cash application. The result is fewer overdue invoices, stronger customer relationships, and healthier cash flow management.

Companies that adopt the right accounts receivable automation software lower days sales outstanding, reduce human error, and free finance teams from repetitive manual accounting tasks. With AI, real-time dashboards, and customer portals, the future of automating accounts receivable is faster, smarter, and more customer-focused.