TL;DR – AI in Accounting: Key Takeaways

- AI is transforming accounting by automating tasks like data entry, invoice processing, and tax return preparation.

- It improves accuracy, reduces human error, and speeds up financial reporting and audits.

- Tools like QuickBooks, Xero, Vic.ai, and Botkeeper help firms of all sizes implement AI quickly.

- Accounting teams benefit from real-time data insights, fraud detection, and predictive analytics.

- Smaller accounting firms can now compete with enterprise-level automation and reporting.

- Common challenges include data privacy, resistance to change, and the need for upskilling.

- AI will not replace accountants, but rather enhance their roles with deeper analysis and strategic focus.

- The future of accounting lies in AI-human collaboration, smarter systems, and value-added advisory services.

AI in accounting is the use of artificial intelligence to automate financial tasks, enhance data accuracy, and support strategic decisions. Artificial intelligence is transforming the accounting profession, and fast. From automating data entry to streamlining invoice processing and enhancing financial reporting, AI is changing how accounting firms work at every level.

These innovations are not about replacing humans. Instead, they’re assisting accountants, reducing human error, and helping accounting teams make better decisions with cleaner financial data. With tools powered by machine learning and natural language processing, firms can save time, improve cash flow, and even catch fraud faster.

Today, even smaller accounting firms are adopting AI tools to optimize accounting processes like tax return preparation, expense management, and predictive analytics. Still, human expertise remains essential for judgment, compliance, and oversight.

In this article, we’ll break down how accounting AI is reshaping the industry, what tools are driving the change, and what it all means for the future of financial management.

What Is AI in Accounting?

AI in accounting refers to the use of artificial intelligence technologies, like machine learning, natural language processing, and robotic process automation, to improve, automate, and enhance core accounting processes. It’s not just about doing tasks faster; it’s about doing them smarter and with fewer mistakes.

Traditionally, accounting professionals spent hours on manual data entry, spreadsheet reconciliations, and preparing financial statements. Now, AI-integrated accounting systems can handle these routine tasks automatically. From invoice processing and accounts payable to tax return preparation, AI reduces the need for constant human input while improving accuracy.

For instance, an AI-powered tool can scan receipts, match them to a bank feed, and update an expense report, all in real time. A task that might take a full accounting team a day or more can now be completed in minutes with fewer errors and greater consistency.

From Automation to Insights: The Real Value of Accounting AI

Beyond automation, AI brings deep analytical power. With the ability to digest and assess massive amounts of financial data, AI excels at data analysis, spotting anomalies, and uncovering trends, including search behavior insights relevant to accountants that can shape smarter content and service positioning online. These capabilities allow firms to identify patterns early and make better, faster decisions.

One of the most transformative developments is AI’s role in predictive analytics. By analyzing spending patterns, seasonal cycles, and revenue forecasts, AI helps accounting firms stay ahead of risks like cash flow shortfalls or budget overruns. This supports sharper strategic decision making.

Importantly, AI doesn’t eliminate jobs, it enhances them. Accounting AI empowers tax professionals, auditors, and analysts by doing the heavy lifting behind the scenes. This lets human experts focus on advisory work, regulatory oversight, and value-added services that machines can’t replicate.

From fraud detection and tax compliance to financial reporting and audit enhancement, AI has quickly become a critical part of modern accounting software. Whether you’re running a solo practice or part of a global enterprise, implementing AI isn’t just smart, it’s necessary to compete in today’s evolving accounting landscape.

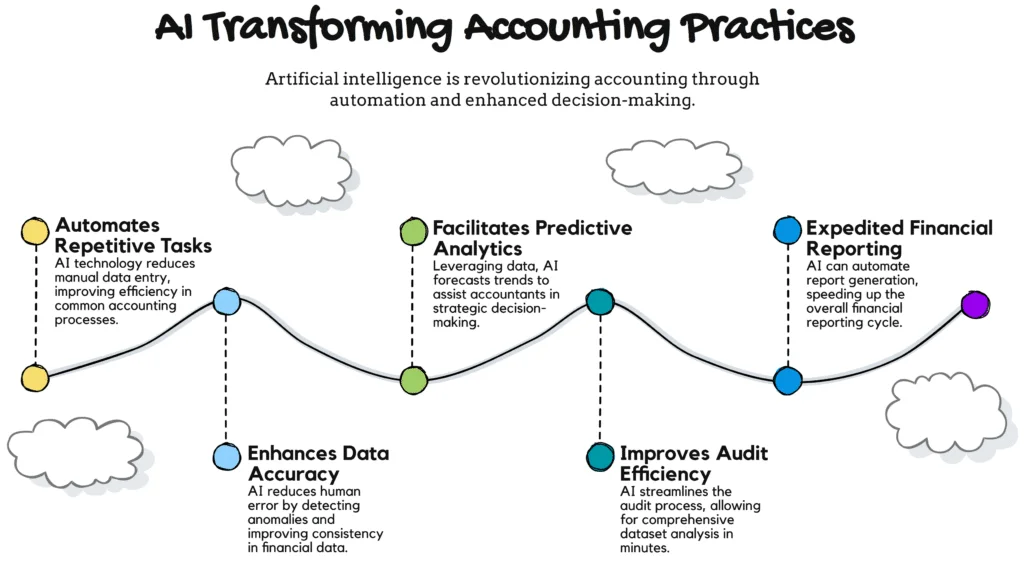

How AI Is Transforming the Accounting Profession

Artificial intelligence isn’t just enhancing accounting, it’s reengineering it. Across firms of all sizes, AI is being used to automate, analyze, and optimize workflows that once relied entirely on manual labor. Below are 13 key ways AI is transforming the accounting industry, each one offering significant benefits in speed, accuracy, and strategic value.

Automating Manual Tasks Like Data Entry

AI can now handle manual data entry, pulling figures from receipts, bank statements, or PDFs and inputting them directly into accounting systems. This reduces the burden on accounting professionals and minimizes human error in core accounting processes.

Improving Accuracy and Reducing Human Error

AI technologies detect inconsistencies and flag anomalies in financial data, helping accounting teams improve accuracy. When machines handle the repetitive stuff, the margin for error drops significantly, especially in areas like expense management and financial reporting.

Freeing Up Time by Automating Routine Tasks

Tasks like invoice processing, accounts payable, and expense reports can be fully automated with AI. This shift allows staff to focus on higher-level thinking and value-added services, while machines handle the background work.

Supporting, Not Replacing, Human Expertise

Despite fears that AI will replace accountants, the reality is quite the opposite. AI supports tax professionals, auditors, and analysts by enhancing their workflows, not replacing their decision-making power. Human judgment remains central to tasks like financial audits, compliance, and strategy.

Revolutionizing the Audit Process

AI helps auditors analyze 100% of a dataset in minutes, something that would take weeks using traditional sampling methods. This speeds up the audit process, improves accuracy, and strengthens trust in financial statements.

Redefining Accounting Through Automation

At its core, AI in accounting overlaps heavily with accounting automation, leveraging intelligent algorithms to handle tasks like accounts payable, ledger classification, and transaction matching.. It’s already deeply embedded in popular accounting software used by tax and accounting firms worldwide.

Enabling Faster and Deeper Data Analysis

AI is accelerating data analysis by scanning thousands of transactions in seconds. This makes it easier for firms to identify patterns, detect anomalies, and flag compliance risks buried deep within accounting data.

Powering Predictive Financial Analysis

Using machine learning, AI tools can detect future trends and provide predictive analytics around revenue, expenses, and cash flow. This empowers leaders to make data-informed decisions well in advance.

Accelerating Invoice and Report Generation

Through touchless invoice processing, AI can read, interpret, and file invoices without any human input. This capability shortens billing cycles and improves the timeliness of financial reporting.

Handling Complex Accounting Tasks with AI Technology

With the help of natural language processing and machine learning algorithms, AI can now manage tasks once thought too nuanced for automation, like project-based allocations or client billing reconciliations.

Detecting and Preventing Fraud

AI’s ability to scan massive amounts of financial transactions enables faster, more accurate fraud detection. It can flag abnormal patterns in real time, long before human reviewers might catch them.

Supporting Strategic Decision Making

AI provides valuable insights derived from analyzing large volumes of financial data, which can guide firm leaders in areas like budgeting, resource allocation, and tax compliance.

Driving Efficiency Across Firms of All Sizes

AI is no longer a tool reserved for enterprises. Today, smaller accounting firms are embracing AI-powered accounting solutions to stay competitive, reduce overhead, and deliver better service to clients.

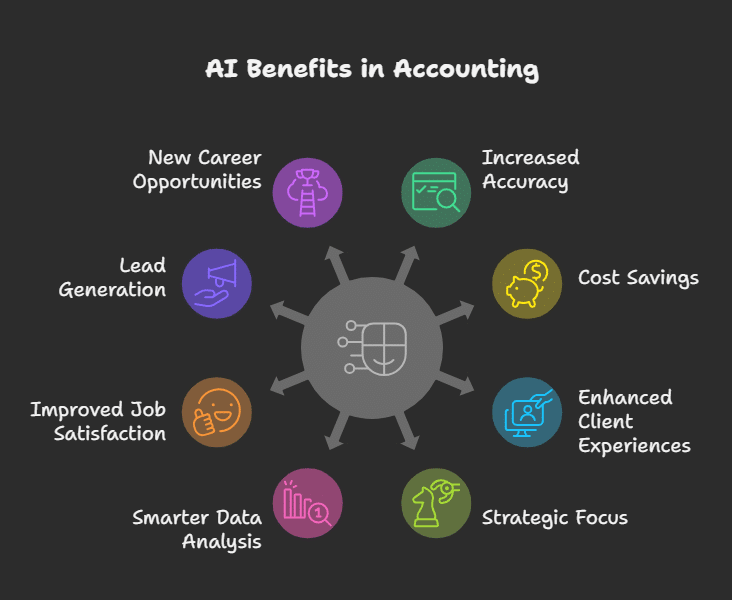

Benefits of AI in Accounting

The adoption of AI-powered tools in the accounting profession is no longer experimental, it’s essential. From reducing costs to improving client service, AI in accounting offers significant benefits that help firms operate more efficiently and strategically. Below are eight key advantages that highlight why accounting firms and tax professionals are embracing AI across their operations.

Increased Accuracy and Efficiency

AI drastically reduces human error by automating repetitive and rules-based tasks like data entry, invoice processing, and accounts payable. These improvements lead to more accurate financial statements, smoother reconciliations, and fewer compliance issues. By automating such routine tasks, AI helps teams maintain consistent performance, even during peak periods like tax season.

Cost Savings on Manual Work

Replacing repetitive tasks with AI systems cuts labor hours and reduces reliance on outsourced bookkeeping. For many smaller accounting firms, this translates into direct cost savings, allowing them to invest in better tools, training, or client services without stretching their budgets.

Enhanced Client Experiences

AI enables firms to deliver faster responses, real-time updates, and personalized insights through strong user experience, helping clients engage with accounting platforms more confidently. Through automated alerts and smart dashboards, accounting software powered by AI keeps clients informed and supported, improving both satisfaction and retention.

More Time for Strategic Work

By automating routine tasks, AI allows accountants to shift their focus from transaction processing to strategic initiatives. That means more bandwidth for advising clients, conducting strategic analysis, and uncovering new business growth opportunities.

Smarter Data Analysis and Insights

AI doesn’t just process data, it makes sense of it. Tools powered by machine learning and predictive analytics help identify trends in financial data that might otherwise go unnoticed. This level of data analysis supports more accurate forecasting and smarter decision making.

Improved Job Satisfaction for Accountants

Repetitive and mundane tasks like scanning receipts or inputting numbers into spreadsheets can lead to burnout. AI automates the tedious parts of accounting, improving quality of life for professionals and giving them space to focus on meaningful, impactful work.

Lead Generation Through AI-Generated Content

Some AI tools can even help firms attract new clients by creating high-quality content such as blogs, FAQs, or service descriptions, positioning the firm as a thought leader while passively generating leads through SEO.

New Career Opportunities in AI and Accounting

Rather than eliminating jobs, AI adoption is creating new ones. Roles like AI systems trainer, accounting technologist, or data strategist are emerging in modern firms. For forward-thinking accounting professionals, the skills gap is an opportunity, not a threat.

These benefits show how implementing AI can make all the difference in a firm’s productivity, growth, and service quality. But what tools are actually powering these gains? Let’s explore the top AI tools used by today’s accountants.

Top AI Tools for Accountants

As AI adoption accelerates across the accounting industry, many firms are turning to specialized software to modernize their workflows. These AI-powered tools don’t just automate basic tasks, they integrate with accounting systems, enhance financial processes, and deliver insights that would take humans hours to compile. Below are 10 standout accounting solutions that are transforming the day-to-day work of accounting professionals, from invoice processing to project management.

QuickBooks

QuickBooks is a widely used cloud-based accounting software tailored for small to midsize businesses. It now integrates AI technology to streamline invoice processing, expense reports, and cash flow forecasting. Smart categorization features reduce the need for manual data entry and help identify unusual spending patterns.

Zoho Books

Zoho Books offers AI-assisted automation for tax return preparation, accounts payable, and real-time business communications. It’s particularly popular among freelancers and smaller accounting firms, thanks to its ease of use and built-in compliance tracking.

Xero

Xero includes AI features for bank reconciliation, smart invoicing, and financial reporting. Its intuitive dashboard uses predictive analytics to flag cash shortfalls and performance dips, making it a favorite for firms needing visual financial data summaries.

Vic.ai

Vic.ai is a niche platform focused on AI-driven accounts payable automation. It uses machine learning to analyze transactions, reduce processing time, and eliminate human involvement in invoice approvals. For firms handling a high volume of vendor payments, it’s a game changer.

Sage Intacct

Sage Intacct combines cloud-based flexibility with robust financial management features. It leverages AI systems to automate data flows between departments, support expense management, and detect anomalies across financial transactions.

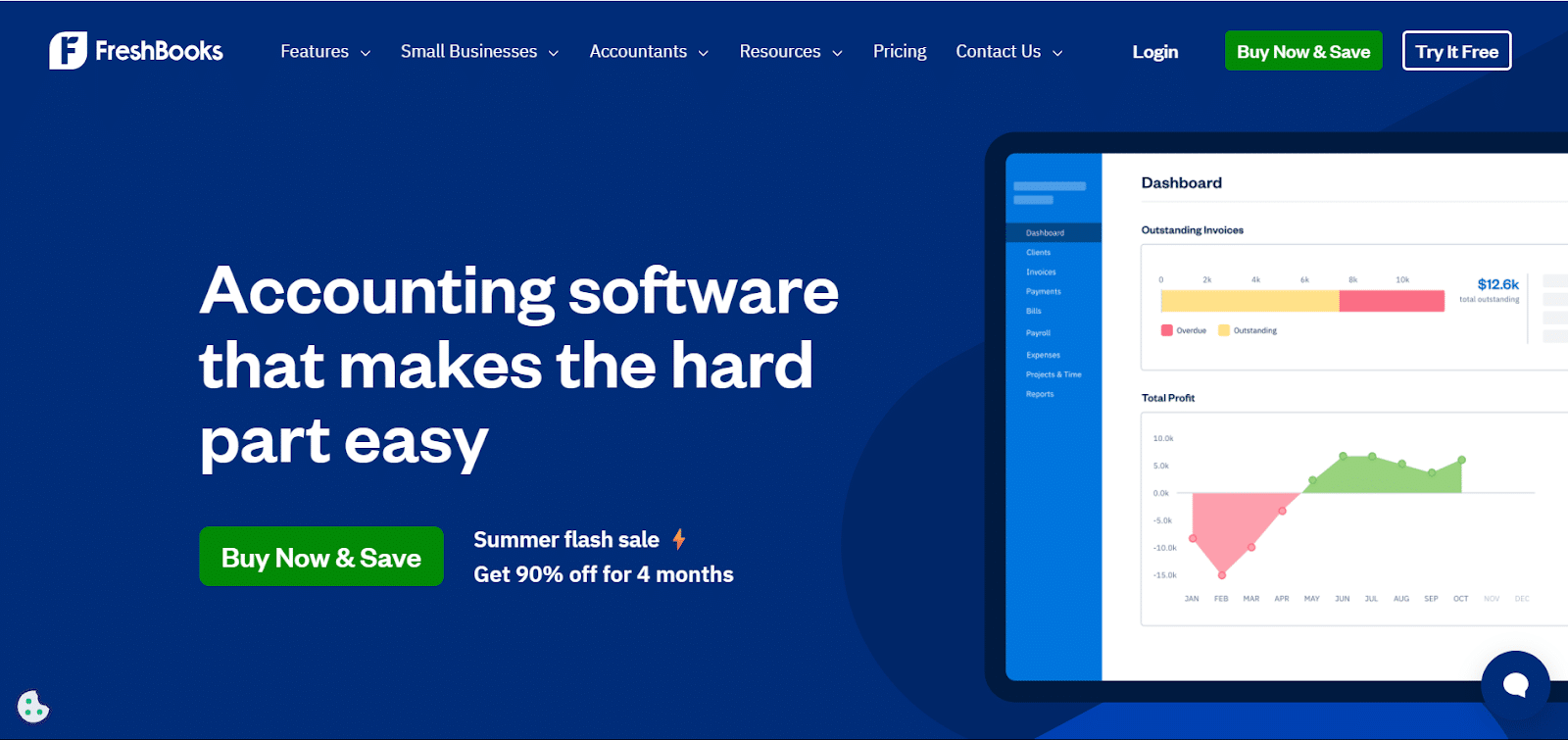

FreshBooks

Designed for small businesses and solopreneurs, FreshBooks uses AI technology for smart invoicing, automatic time tracking, and intuitive reporting. It simplifies project management and gives accounting professionals fast access to client data and billable hours.

NetSuite

NetSuite, an Oracle product, is a comprehensive ERP solution that integrates accounting AI into its core modules. It supports large firms by providing unified control over financial statements, accounts payable, compliance, and tax compliance across multiple locations.

Trullion

Trullion is an emerging AI-powered platform designed to handle lease accounting, revenue recognition, and financial audits. It reads contracts using natural language processing, extracts key figures, and automatically populates journal entries, minimizing errors and saving time.

Botkeeper

Botkeeper offers a hybrid model, combining AI tools with human expertise. It’s especially useful for tax firms looking to automate bookkeeping while maintaining personalized client oversight. Botkeeper handles data entry, expense reports, and predictive analytics with minimal setup.

Sage (Core AI Suite)

Beyond Sage Intacct, the broader Sage ecosystem now includes advanced generative AI tools that enhance automation, fraud alerts, and reporting features. These tools integrate with popular accounting software platforms, offering flexibility and scalability for growing firms.

Whether you’re a solo accountant or leading a full accounting team, choosing the right AI-powered tools can streamline operations, improve financial data accuracy, and reduce costs. But adopting these tools also comes with challenges. In the next section, we’ll explore the hurdles that tax and accounting firms face when embracing AI.

Challenges of AI in Accounting

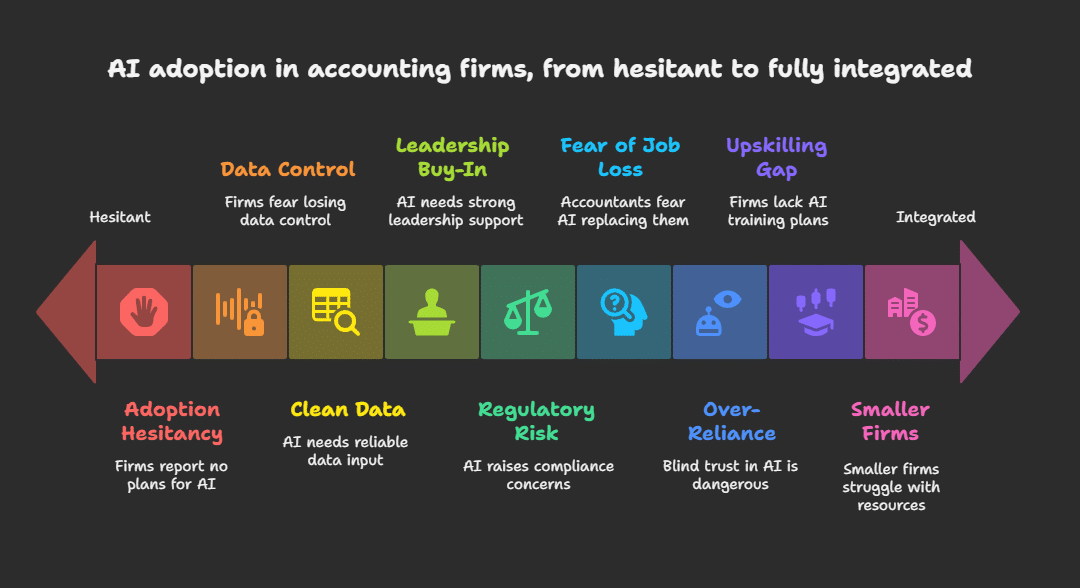

While AI brings enormous promise to the accounting landscape, the road to adoption isn’t without hurdles. Many tax and accounting firms still hesitate to fully embrace AI-powered tools, often due to concerns around data, training, and cultural resistance. Below are nine key challenges facing firms today as they integrate accounting AI into their operations.

Adoption Hesitancy Among Firms: Surprisingly, nearly 49% of accounting firms report having no current plans to use generative AI tools. Another 30% are still in the consideration phase, leaving only a small percentage actively implementing AI. This slow movement is often driven by uncertainty around ROI, compliance, and long-term stability.

Concerns Over Data Control and Privacy: Many firms fear losing control over sensitive accounting data when processed through AI systems. With increased reliance on cloud-based accounting software, the risks of data breaches or mishandling of confidential financial transactions become more prominent, especially for tax firms handling client returns and payroll.

The Need for Clean, Reliable Data: AI models are only as good as the data they’re fed. Inconsistent or incomplete data inputs can lead to inaccurate predictive analytics or misclassified entries during invoice processing. This makes data quality a major barrier to effective AI deployment, particularly for firms with legacy or siloed accounting systems.

Lack of Leadership Buy-In: AI adoption can’t succeed without strong support from business leaders. In many cases, firm executives either lack understanding of the technology or view it as a risk rather than an opportunity. Without leadership modeling and funding the change, AI initiatives struggle to gain traction.

Data Compliance and Regulatory Risk: AI’s ability to automate financial reporting and analyze sensitive data raises compliance flags. Firms must consider tax compliance, GDPR, and industry-specific audit regulations. Any errors or oversight in the audit process caused by AI can create legal and financial liability.

Fear of Job Loss Among Accountants: A persistent challenge is the belief that AI will replace accountants. This fear leads to internal resistance, especially among seasoned professionals concerned about job security. However, most AI applications are designed to assist accountants, not eliminate their roles.

Over-Reliance on Automation: As powerful as AI is, it’s not perfect. A blind trust in automated systems can be dangerous, especially when human oversight is removed from tasks like tax return preparation, fraud checks, or complex journal entries. Over-reliance on technology without a safety net may result in critical errors.

Upskilling and the Growing Skills Gap: Adopting AI often requires existing staff to learn new platforms and workflows. Unfortunately, many firms lack a clear plan to bridge this skills gap. Without training in AI expertise, employees struggle to get the most out of their tools, slowing down implementation and creating tension across teams.

Smaller Firms Struggle with Resources: While enterprise firms often have the budget and teams to experiment with AI, many smaller accounting firms face challenges in cost, integration, and training. Implementing even basic accounting solutions can strain time and resources, making scalability a long-term concern.

Despite these challenges, the future of AI in accounting is bright, especially for those who prepare for it. In the next section, we’ll explore what lies ahead, including emerging trends, market growth, and how firms are evolving to meet the AI-driven future head-on.

FAQs

1. How is AI used in accounting?

AI is used in accounting to automate repetitive tasks like data entry, invoice processing, and accounts payable. It also enhances financial reporting, assists in fraud detection, and powers predictive analytics by analyzing large volumes of financial data. AI helps accounting professionals save time, reduce errors, and make more informed decisions based on real-time insights.

2. Is AI going to replace accountants?

No, AI is not going to replace accountants. Instead, it’s transforming the role by handling routine tasks and allowing professionals to focus on strategic decision making, client advisory, and compliance. AI supports, rather than replaces, human judgment, especially in areas that require critical thinking and industry expertise.

3. What is the future of AI in accounting?

The future of AI in accounting includes broader automation of accounting processes, smarter AI-powered tools, and deeper integration into accounting software. By 2030, the percentage of human-performed tasks is expected to drop significantly, but new roles will emerge. Accountants will increasingly act as advisors, using AI to interpret data and drive business growth.

4. What is the best AI tool for accounting?

The best AI tools for accounting depend on your firm’s size and needs. Popular platforms include QuickBooks, Xero, Zoho Books, Vic.ai, and Botkeeper. These tools offer features like predictive analytics, natural language processing, and automated financial processes. For smaller accounting firms, cloud-based tools with built-in AI are often the most cost-effective and scalable.

Conclusion

Artificial intelligence has already proven its power to streamline accounting processes, enhance data analysis, and eliminate the burden of manual data entry, but this is just the beginning. From solo practitioners to global accounting firms, those who invest in AI-powered tools today are setting themselves up for a smarter, more scalable future.

Across every function, from tax return preparation and invoice processing to financial reporting and cash flow forecasting, AI is driving real change. It’s making the audit process faster, improving fraud detection, and helping firms make sharper, real-time decisions based on clean, connected financial data.

But perhaps the most important shift isn’t technical, it’s cultural. The firms that will lead the next chapter of the accounting industry aren’t the ones with the biggest software budgets. They’re the ones who combine human expertise with AI systems to create more agile, insightful, and forward-thinking accounting teams.

Whether you’re exploring AI for the first time or scaling its use across your operations, one thing is clear: embracing accounting AI isn’t about staying trendy, it’s about staying relevant.

Now is the time to experiment, train, and implement. Because in the world of modern accounting, those who understand how to use AI will define what’s possible.

Ready to make AI work for your accounting firm?

At Ventnor Web Agency, we design high-converting, AI-ready websites tailored for accountants and financial professionals. If you’re implementing AI tools, your website should reflect that innovation contact us today.