Managing finances is one of the most demanding parts of running a business. From tax preparation and payroll processing to financial reporting and audits, the work adds up fast. That’s why many companies are turning to offshore accounting services, a smarter way to handle these tasks without overloading your in-house team.

Offshore accounting isn’t just about cutting costs. It’s about gaining access to a global talent pool, tapping into specialized expertise, and unlocking high-quality accounting services that support business growth. Whether you’re a startup trying to stay lean or a growing accounting firm looking to scale efficiently, partnering with offshore accounting service providers can help you streamline accounting functions, save time, and improve accuracy.

In this guide, we’ll break down what offshore accounting actually means, the types of services offered, key benefits and risks, and how to choose the right offshore provider. You’ll also learn best practices for working with an offshore accounting team, so you can make informed decisions that align with your goals and keep your financial data secure.

What Is Offshore Accounting?

Offshore accounting is the practice of hiring an external service provider in another country to handle your accounting tasks. Instead of building or expanding your in-house accounting staff, you delegate work to a remote offshore accounting team, often based in regions known for lower labor costs and high-quality talent.

These offshore accounting services can include everything from bookkeeping and tax preparation to payroll processing, financial reporting, and audit support. While traditional accounting firms may rely on local hires, businesses that go offshore gain flexibility, speed, and access to a broader range of skilled professionals.

It’s not just about saving money, though cost savings are a major draw. Offshore accounting also gives you a competitive edge by connecting you to a global talent pool with specialized expertise in international accounting standards, compliance, and digital tools. That’s especially valuable for companies with complex operations or plans for international expansion.

Here’s how offshore accounting differs from traditional models:

- Location: Offshore teams operate outside your own country, often in time zones that allow work to be done overnight.

- Structure: You work with an external offshore accounting firm or independent offshore accountants, not your internal employees.

- Scope: Offshore providers can handle both routine and complex accounting tasks, depending on your business needs.

- Technology: Offshore teams often rely on cloud-based accounting software and collaboration platforms, making workflows more efficient and enabling faster access to your financial records.

In-House vs Offshore Accounting: Key Differences

| Feature | In-House Accounting | Offshore Accounting |

| Team Location | Based in your own country | Based in another country (offshore) |

| Cost | Higher costs (salaries, benefits, office space, tools) | Up to 70% cost savings through offshore workers |

| Talent Access | Limited to local hiring market | Access to a global talent pool with specialized expertise |

| Scalability | Harder to scale quickly; fixed staffing model | Flexible team scaling up or down based on business needs |

| Technology & Tools | Tools must be purchased and managed in-house | Offshore provider typically includes and manages modern tools |

| Focus for In-House Team | Time split between routine and strategic tasks | Local team can focus more on strategy and client-facing work |

| Time Zone Advantage | No overnight productivity; 9–5 limitation | Enables 24/7 productivity with asynchronous workflows |

| Compliance & Security | Internal team manages data security and compliance | Offshore provider handles it (must ensure certifications and trust) |

Businesses of all sizes, from ecommerce startups to large accounting firms, use offshore services to manage day-to-day financial functions, meet regulatory deadlines, and stay focused on core business activities. Done right, it’s not just outsourcing, it’s a strategic business move.

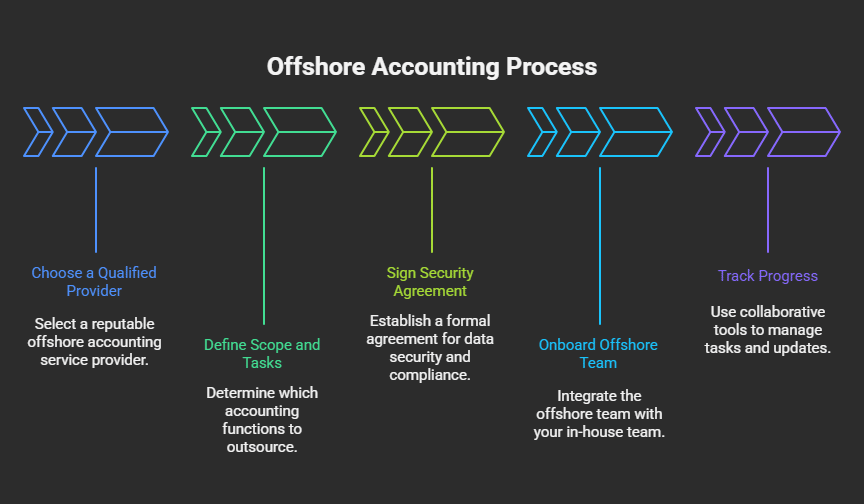

How Offshore Accounting Works (Step-by-Step)

Offshore accounting may sound complex, but the process is straightforward when done right. Here’s how most businesses set up and manage a successful offshore accounting partnership:

Choose a Qualified Offshore Provider

Start by researching reputable offshore accounting service providers. Look for firms with experience in your industry, strong data security credentials, and a track record of delivering high-quality accounting services.

Define the Scope and Accounting Tasks

Decide which accounting functions you want to outsource, this could include payroll processing, tax preparation, financial reporting, or accounts receivable. Clear scope = fewer misunderstandings later.

Sign a Data Security & Compliance Agreement

Before onboarding your offshore team, lock in a formal agreement covering data security, financial data handling, and compliance with local tax laws and global standards. This protects both parties.

Onboard Your Offshore Accounting Team

Provide access to systems, share SOPs, and introduce them to your in house team. A structured onboarding process builds alignment and trust from day one.

Track Progress Using Collaborative Tools

Use cloud-based tools like Xero, QuickBooks, ClickUp, or Slack to manage tasks, share updates, and review deliverables. This ensures real-time visibility and seamless integration between your teams.

Offshore Accounting Services

Offshore accounting firms offer a wide range of accounting services designed to support both routine and high-level financial operations. Whether you’re a small business owner or part of a growing accounting firm, partnering with an offshore provider allows you to delegate time-consuming accounting tasks to experienced professionals, without sacrificing quality or control.

Below are the core offshore accounting services most businesses rely on:

1. Bookkeeping

At the foundation of any finance department is accurate recordkeeping. Offshore bookkeeping services handle daily entries, reconcile bank statements, track expenses, and maintain up-to-date financial records all essential to healthy accounting practices. With the right team, you get consistent reports and a clear view of your business’s financial health.

2. Payroll Processing

Payroll services are one of the most commonly outsourced functions. Offshore teams manage everything from salary calculations and tax withholdings to benefits tracking and end-of-year reporting. Delegating payroll processing reduces errors, ensures compliance with local tax laws, and saves your in-house team hours of work each month.

3. Tax Preparation

Whether you operate in one country or across several, tax preparation can quickly become a drain on resources. Offshore accountants are often trained in cross-border tax rules and accounting standards, making them ideal for businesses that need accurate, timely filings and strategic tax guidance.

4. Financial Reporting

Timely and accurate financial reporting is critical for business planning, compliance, and decision-making. Your offshore accounting team can prepare profit-and-loss statements, balance sheets, and cash flow reports customized to your industry or internal KPIs. These reports help drive smarter strategic planning and keep stakeholders informed.

5. Audit Support

Many offshore accounting service providers offer audit preparation as part of their offering. That includes organizing documentation, reviewing prior reports, and supporting internal or external auditors. A solid offshore partner ensures you stay ready, whether it’s a scheduled audit or a surprise request.

6. Accounts Payable (AP)

Managing what you owe is just as important as tracking revenue. Offshore teams handle AP workflows by recording vendor invoices, ensuring payment deadlines are met, and reconciling account statements, reducing the risk of missed payments or duplicate entries.

7. Accounts Receivable (AR)

AR tasks focus on tracking payments owed to you by clients. Your offshore team monitors outstanding invoices, follows up on late payments, and keeps cash flow healthy. Done well, AR services reduce revenue leakage and improve your financial outlook.

8. Financial Statement Preparation

Beyond basic reporting, offshore accountants can manage the preparation of formal financial statements that meet compliance and presentation standards. These documents are essential for attracting investors, securing loans, or satisfying board requirements.

With the right offshore accounting firm, you can combine these services into a customized solution that matches your growth stage, compliance requirements, and workload. By outsourcing these key accounting functions, you empower your internal team members to focus on core business activities, while your offshore team ensures accuracy, timeliness, and peace of mind.

Benefits of Offshore Accounting

Choosing offshore accounting isn’t just about saving money, it’s about building a smarter, more scalable finance function. Businesses across industries are turning to offshore accounting service providers to lighten workloads, access specialized expertise, and run leaner teams without compromising on quality.

Here are the biggest benefits of going offshore:

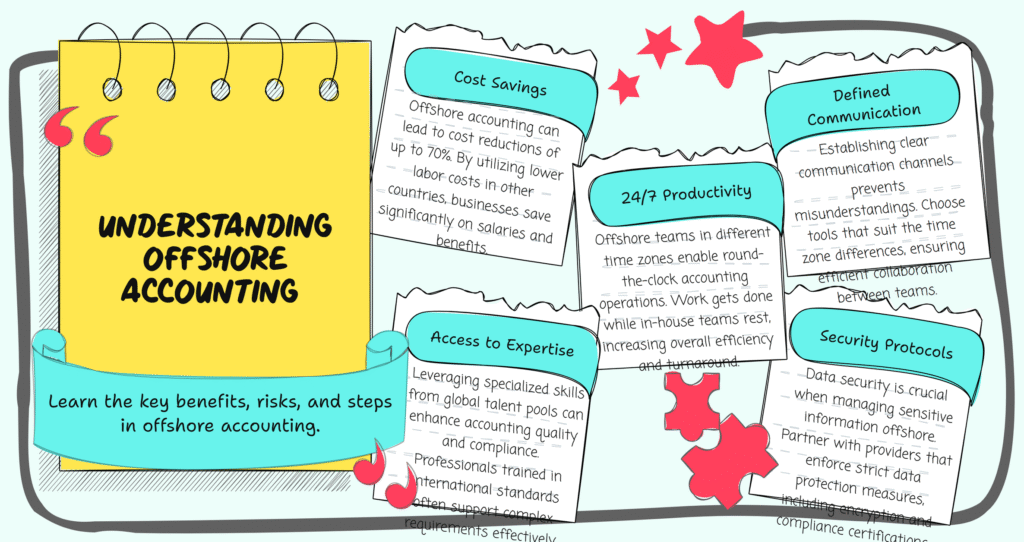

Significant Cost Savings

Hiring a full-time local accountant comes with high overhead, salaries, equipment, office space, and software licenses. With offshore accounting services, you often see cost savings of up to 70% by leveraging offshore workers in regions with lower labor costs and efficient workflows. These savings can be reinvested into marketing, hiring, or core business activities.

Access to a Global Talent Pool

When you hire locally, you’re limited by geography. Offshore accounting opens you up to a global talent pool filled with experienced accounting professionals trained in international finance, tax law, and the latest accounting tools. You get access to talent that may not be available, or affordable, in your own country.

Easier Hiring Process

Need help fast? Many offshore firms offer ready-to-onboard offshore accountants who are already trained, certified, and familiar with industry tools. This speeds up onboarding, reduces HR headaches, and helps your accounting firm stay agile in fast-moving markets.

Specialized Expertise on Demand

Whether it’s international tax preparation, financial modeling, or regulatory reporting, offshore accounting offers access to professionals with deep specialized expertise. These experts are often familiar with multiple jurisdictions and can handle complex accounting tasks that your local team might not be trained for.

Flexible Team Scaling

Business needs change fast. With an offshore provider, you can scale your accounting team up or down based on seasonality, contracts, or cash flow. This kind of flexibility is nearly impossible with full-time, salaried staff, and it keeps your business lean without sacrificing capability.

Increased Efficiency

Outsourced accounting helps companies significantly enhance efficiency. Offshore teams often follow streamlined workflows, use task automation, and collaborate in real time using secure tools. As a result, your accounting processes run smoother, faster, and with fewer errors.

Around-the-Clock Productivity

If your in house accounting staff works 9–5, you lose time outside those hours. Offshore teams extend your business hours and help you move toward 24/7 productivity. This is especially valuable when deadlines are tight or when your business operates across different time zones.

Choosing an Offshore Accounting Partner

Not all offshore accounting service providers are created equal. Choosing the right service provider can make the difference between a seamless, cost-effective partnership, and a stressful experience filled with delays and miscommunication.

Here’s what to look for when evaluating potential offshore partners:

Cost-Effective but High Quality

Yes, one of the top reasons for using offshore accounting services is to achieve cost savings, but cheaper isn’t always better. Look for providers that offer competitive pricing without compromising on service quality, communication, or accuracy. Ask whether their pricing structure is fixed, hourly, or project-based, and if any hidden costs are involved.

Strong Data Security Protocols

When working with sensitive financial data, nothing matters more than trust. Make sure your offshore accounting firm follows strict data security protocols, think encryption, role-based access controls, and routine audits. Ask for their certifications and whether they’re compliant with international data privacy laws like GDPR or SOC 2. This helps you avoid potential data security concerns down the line.

Proven Expertise and Skilled Professionals

Your offshore partner should bring more than just labor, they should bring talent. Look for skilled professionals with experience handling the accounting tasks you need, whether that’s tax preparation, financial reporting, or payroll services. The best offshore providers often specialize in serving specific industries or handling complex accounting tasks, giving you peace of mind that you’re in good hands.

Clear and Consistent Communication

Time zones and cultural differences can cause friction, but the real culprit in most failed partnerships is unclear communication. Ask how your offshore team will communicate with you. Will there be a dedicated account manager? Do they use tools like Slack, Zoom, or ClickUp? How quickly do they respond to emails? Consistent, transparent communication keeps everyone aligned.

Clear Expectations from the Start

A good service provider should help you define project scopes, deadlines, and goals before work begins. Clarity upfront avoids delays and scope creep. Set expectations around KPIs, reporting cadence, and escalation protocols to keep the relationship productive long-term.

Finding the right offshore provider is less about price tags and more about alignment, on values, systems, and expectations. When done right, a partnership with the right offshore accounting firm doesn’t just support your business, it strengthens it.

Related: GDPR for Accountants, Busy Season for Acountants

Challenges of Offshore Accounting

Offshore accounting brings major advantages, but it’s not without its challenges. To make the most of your partnership, it’s important to understand the potential downsides and how to prepare for them. The good news? Most issues are preventable with the right systems, people, and mindset in place.

Here are the most common hurdles businesses face when working with an offshore accounting firm or offshore accounting team:

Communication Issues

Clear communication can be tricky when you’re working with people in different time zones, especially when cultural differences or language barriers come into play. Misunderstandings over deliverables, timelines, or task ownership can slow things down.

Solution: Use collaboration tools, keep instructions clear and documented, and set expectations for response times and weekly check-ins. If needed, assign a liaison from your in house team to manage day-to-day coordination.

Data Security Concerns

Sharing sensitive financial data across borders can raise red flags, especially if your offshore accounting services provider doesn’t have robust data security practices in place. The risk of breaches or mishandling of sensitive financial data is real.

Solution: Vet all potential service providers for certifications (like ISO or SOC 2), ask about encryption protocols, and confirm they use secure accounting software. You should also draft a clear data handling agreement as part of your contract.

Time Zone Differences

Working across time zones can delay responses and create friction when real-time decisions are needed. This is especially tough for tasks that require back-and-forth clarification, like tax preparation or audit support.

Solution: Structure your workflow to take advantage of time differences, handoff tasks at the end of your day and receive updates the next morning. Use project management tools with time-based task assignments, and agree on overlap hours for urgent issues.

Cultural Misalignment

Even small cultural differences can impact team members’ motivation, engagement, and collaboration. In some cultures, asking questions or saying “no” may be discouraged, leading to unspoken confusion and missed deadlines.

Solution: Foster an environment of psychological safety and respect. Offer onboarding that introduces your work culture, and encourage honest feedback from your offshore accounting staff or partners.

Misunderstandings and Scope Creep

Sometimes, it’s not what’s said, it’s what’s assumed. Vague scopes, verbal agreements, or last-minute changes can lead to missed deliverables or strained relationships with your offshore provider.

Solution: Set clear scopes and KPIs upfront. Document workflows, create shared dashboards, and review deliverables regularly. Structure your projects just like you would with your in house accounting staff, clear, repeatable, and trackable.

Facing these challenges head-on doesn’t mean avoiding offshore accounting. It means setting it up for success. With proactive communication, strong security protocols, and mutual respect, your offshore team can become a reliable extension of your own operations.

Offshore Accounting Best Practices

Working with an offshore accounting team is a smart move, but success doesn’t happen by accident. The difference between a frustrating experience and a high-performing partnership often comes down to how you manage the relationship.

Below are proven best practices to get the most from your offshore accounting services:

Prioritize Clear Communication

Misunderstandings around accounting tasks or delivery timelines can derail even the best partnerships. Set communication channels early, whether that’s email, Slack, or a project management tool, and establish when updates are expected. A shared workspace helps both your in house team and offshore provider stay aligned in real time.

Avoid Micromanaging Across Time Zones

Trying to control every detail defeats the purpose of working with an offshore accounting firm. Instead of monitoring hours, focus on results. Let your offshore accounting staff complete work independently, and use reporting tools to track progress without disrupting flow.

Hire a Local Manager or Team Lead

If you’re working with a large dedicated offshore team, having a team lead on the ground makes a huge difference. They can bridge communication gaps, handle time zone logistics, and serve as your eyes and ears, especially when dealing with multiple accounting functions like payroll processing, financial reporting, and tax preparation.

Focus on Outcomes, Not Hours

It’s tempting to track every minute, but productivity in offshore work isn’t about time, it’s about value. Judge your offshore accounting services by quality, turnaround time, and error rates. Output should be measured by how well accounting duties are completed, not how many hours were spent.

Invest in Onboarding and Training

A strong start sets the tone. Whether you’re working with a freelance accountant or a full offshore firm, provide thorough onboarding. Share SOPs, walkthroughs of your accounting software, and a glossary of terms your business uses. This helps your offshore workers integrate smoothly with your own country’s standards and expectations.

Encourage an Open Feedback Culture

The best teams talk openly, about what’s working and what’s not. Regular check-ins, retrospectives, or pulse surveys can help your offshore accounting team feel empowered to speak up. This creates a feedback loop that improves both performance and morale over time.

By following these best practices, you can turn your offshore relationship into a true extension of your business, not just a contract. With the right mindset and systems in place, offshore accounting becomes more than just outsourcing, it becomes a driver of strategic business growth.

FAQs About Offshore Accounting

What is offshore accounting in simple terms?

Offshore accounting is when a business hires a service provider in another country to handle financial tasks like bookkeeping, tax preparation, financial reporting, and payroll processing. It helps save costs and provides access to skilled professionals outside your own country.

What services do offshore accounting firms provide?

Common offshore accounting services include offshore bookkeeping services, payroll, tax preparation, accounts payable and receivable, financial statement preparation, audit support, and compliance. Some providers also offer advisory services and tech integrations.

Is offshore accounting legal and safe?

Yes, offshore accounting is legal as long as it complies with local tax laws and data security regulations. Choose providers with strong compliance services and data protection standards to ensure your sensitive financial data stays secure.

What are the risks of offshore accounting?

Risks include data security concerns, communication issues, time zone differences, and potential cultural differences. These can be managed with strong onboarding, regular check-ins, and clear expectations.

How do I choose the right offshore accounting partner?

Look for a service provider with a strong track record, secure systems, trained accounting professionals, and clear communication processes. Make sure they align with your company culture, goals, and preferred accounting software.

Why is offshore accounting becoming so popular?

Because it offers businesses a way to access high quality services, cut costs, increase efficiency, and gain flexibility, without overloading the in house accounting staff. It’s especially popular among growing accounting firms and tech-forward companies.

Conclusion

Offshore accounting has evolved into more than just a cost-saving tactic, it’s a strategic lever for modern businesses. By partnering with the right offshore accounting service providers, companies can unlock access to a global talent pool, streamline accounting tasks, reduce overhead, and strengthen their overall financial management.

Whether you’re offloading payroll services, upgrading your financial reporting, or looking to scale without expanding your in-house team, offshore accounting provides a smart and scalable solution. With the right setup, systems, and mindset, your offshore accounting team becomes an extension of your core operations, not a distant vendor.

As you consider your next steps, remember: success with offshore accounting isn’t just about where your team sits. It’s about who they are, how well you communicate, and how aligned you are on goals. Treat it as a strategic business move, and you’ll see the long-term payoff in clarity, control, and business growth.