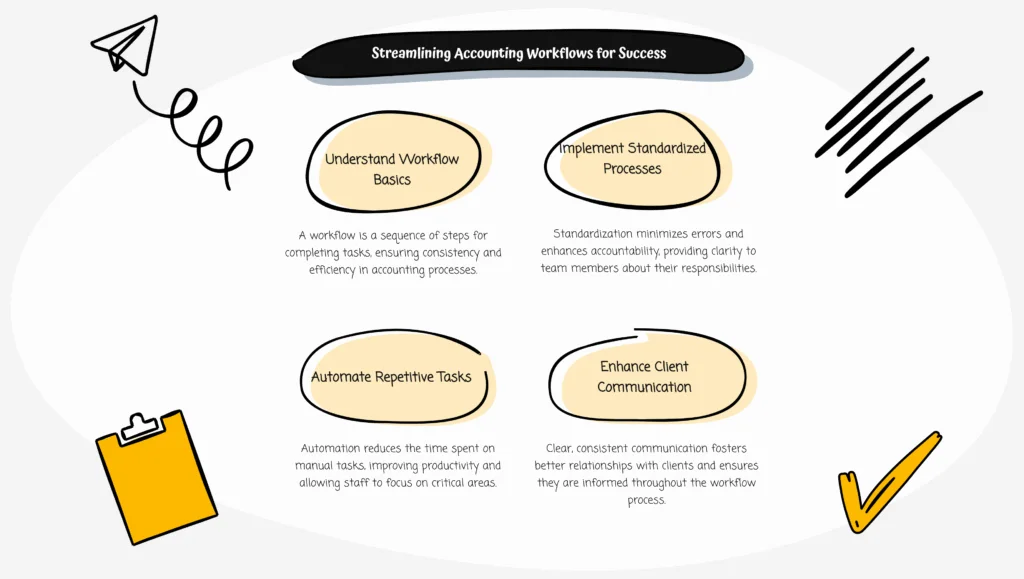

An accounting workflow is a simple system that shows the steps your firm takes to get client work done. Whether it’s monthly bookkeeping, tax prep, or onboarding new clients, having a clear workflow makes everything easier.

Without a structured workflow, it’s easy to miss due dates, lose track of client tasks, or repeat the same questions about client data. That hurts client satisfaction, and your firm’s profitability.

This guide will help you understand what a workflow is, why accounting workflow management matters, and how the right workflow software can improve efficiency, reduce errors, and give your team real-time visibility into every project. Whether you’re running a large accounting firm or you’re a solo accountant, you’ll learn how to build workflows that actually work.

Let’s break it down step by step.

What Is an Accounting Workflow?

An accounting workflow is a step-by-step process your firm follows to complete accounting tasks. It’s the list of actions your team takes, from start to finish, to deliver services like tax prep, payroll, or monthly reporting. Think of it like a checklist, but smarter.

Each step in the workflow process helps you manage multiple tasks, assign the right team member, and keep things moving without confusion. When you have a standardized process, everyone is on the same page, from the partner reviewing the file to the new staff handling data entry.

Here’s an example of a basic monthly bookkeeping workflow:

| Step | Task |

| 1 | Request bank statements from client |

| 2 | Upload statements to document management system |

| 3 | Reconcile accounts |

| 4 | Review and flag any questions |

| 5 | Final review by manager |

| 6 | Send report to client |

This kind of structured workflow keeps client work organized and reduces the need for constant back-and-forth. And no, you don’t need to be tech-savvy to build one. You just need a simple system that repeats for every client or service.

Many accounting firms believe that only tech experts can handle workflow tools. But that’s not true. Even solo accountants or small CPA firms can create effective workflows using basic tools like checklists, templates, or simple workflow management software.

The key is to keep it clear, repeatable, and easy for your team to follow. That’s what turns a scattered process into a streamlined workflow.

Why Accounting Workflow Management Matters

If your firm handles multiple clients, projects, and deadlines, you need a way to stay organized. That’s where accounting workflow management comes in. It helps your team follow the same steps every time, no guessing, no missing steps, no last-minute rush during tax season.

Here’s what strong workflow management can do for your firm:

- Reduce admin work by automating follow-ups, assigning tasks, and sending reminders

- Standardize quality with review checkpoints that catch errors before work goes out the door

- Improve client experience with faster turnaround times, fewer mistakes, and better communication

- Train new team members with clear task lists and procedures, so they don’t have to figure it out from scratch

- Break big projects into small steps so your staff feels confident, even when handling unfamiliar tasks

- Boost team accountability by helping everyone know what to do, when, and why it matters

For example, a workflow tool can notify your team when a client uploads a file, assign the task to the right person, and update the status automatically. You don’t need to manually chase emails or check spreadsheets anymore.

This kind of automation saves time on repetitive tasks and gives your team real-time visibility into where things stand. And when your internal communication is clear, client communication gets easier too.

Whether you’re using sticky notes or the best software on the market, implementing workflows is one of the smartest moves for improving firm efficiency and client satisfaction.

Benefits of Workflow Automation in Accounting

If your team is juggling client work, chasing due dates, and handling recurring tasks by hand, you’re wasting time. Workflow automation helps accounting firms do more with less, without burning out your staff.

Here’s how automated workflows can make a difference:

1. Save Time on Repetitive Tasks: With workflow automation, your firm can automate repetitive tasks like sending reminders, assigning work, or updating task statuses. Studies show it can cut manual work by at least 50%.

| Task | Manual Time | With Automation |

| Sending client reminders | 10–15 mins per task | 0 mins (automated) |

| Assigning tasks to team | 5–10 mins each | 0 mins (automated) |

| Status updates and tracking | 1–2 hours weekly | Done automatically |

2. Increase Productivity: Less time on admin means more time for critical tasks like tax prep, reviewing financials, or helping clients. Teams get more done in less time, without rushing.

3. Improve Accuracy: Structured workflows with built-in reviews reduce errors. You don’t have to rely on memory or guesswork to ensure things are done right.

4. Deliver Consistent, High-Quality Work: Automated workflows make sure client deliverables follow the same steps, even if team members change. That way, quality stays high whether a senior CPA or a new hire is handling the job.

5. Strengthen Client Communication: Clients appreciate clear updates and fast responses. When your workflow tool automates updates or sends requests for client information, it creates a smoother client experience.

Key Accounting Workflows to Implement

Every accounting firm handles similar services, bookkeeping, tax prep, payroll, and more. But not every firm delivers those services the same way. That’s where accounting workflows come in.

A good workflow gives your team a simple, repeatable path to follow so they’re not guessing what comes next. It helps new staff get up to speed, keeps experienced team members on track, and gives clients a smoother experience.

Below are six essential workflows that every firm, big or small, should have in place.

1. Client Onboarding Workflow

Your first impression matters. A strong client onboarding process helps you collect everything you need to get started, without the back-and-forth.

Your onboarding workflow should:

- Gather client data and key documents right away

- Send a clear engagement letter

- Set expectations for timing, communication, and tools

With workflow software, you can automate all of this, and track it from a central location.

2. Invoicing Workflow

Getting paid should never be a guessing game. An invoicing workflow helps you:

- Send invoices on time

- Request payment upfront if needed

- Follow up automatically if invoices go unpaid

Whether you’re billing monthly or by project, this system keeps cash flow steady and reduces admin stress.

3. Document Management Workflow

Lost files lead to delays. And delays frustrate clients.

Your document management process should:

- Keep everything organized and searchable

- Prevent duplicates or outdated versions

- Make files easy to share securely with clients and team members

This is where workflow tools shine, especially when paired with your practice management software.

4. Recurring Task Workflow

Your team handles the same tasks every week, month, and quarter. Missing just one deadline can snowball.

Recurring workflows help you:

- Automate monthly bookkeeping, quarterly reviews, and year-end prep

- Remind team members about what’s due and when

- Keep projects moving, even when it’s busy or someone’s out sick

Tools like Jetpack Workflow or Aero Workflow are built for this kind of work.

5. Service Delivery Workflow

This is where the real work happens. A well-documented service delivery process helps:

- Junior team members take on more without constant supervision

- Senior staff maintain consistency across all client work

- Everyone follow the same standardized process to deliver high quality work

It’s like a checklist that grows with your team.

6. Termination Workflow (Clients or Staff)

When a client leaves, or an employee does, you need a clean way to close things out.

This workflow should cover:

- Wrapping up client tasks or final deliverables

- Transferring files securely

- Documenting everything for legal and recordkeeping

Without a clear process, things can get messy. With one, it’s just another step in your system.

You don’t have to build all these at once. Pick one area, like onboarding or invoicing, and start there. A small change can lead to a streamlined workflow that saves time, reduces errors, and improves client satisfaction.

How to Communicate Workflows to Clients and Teams

Even the best accounting workflow won’t work if no one knows how to follow it. That’s why communication, both with your team and your clients, is a key part of workflow management.

Internal Communication: Keep Your Team on the Same Page

When your team knows exactly what to do and when to do it, work flows smoother. Good workflow management tools give everyone real-time visibility into tasks, deadlines, and who’s responsible.

Here’s how to make sure your team stays aligned:

- Use workflow software that lets you assign tasks and track progress in one central location

- Build standard operating procedures into your workflows so new hires or junior staff know exactly what’s expected

- Include built-in notes, review steps, or tags so team members can collaborate without extra meetings

This kind of clear task management cuts down on back-and-forth questions and helps new team members get comfortable faster.

Client Communication: Make It Easy, Clear, and Consistent

Clients want to know what’s happening without having to chase updates. Your accounting firm workflow should include touchpoints for key moments like onboarding, document requests, or deliverable reviews.

Here’s what helps:

- Automated workflows that send requests for client data or missing documents

- Clear instructions and deadlines for client tasks (like signing an engagement letter or uploading tax forms)

- Regular updates so clients aren’t left guessing about the status of their tax prep or monthly reports

When clients know what to expect, they respond faster, and feel better taken care of. That boosts client engagement and long-term client satisfaction.

Pro Tip:

You don’t need a big system to do this well. Even a simple system with a checklist, a shared folder, and a few automated emails can improve your client experience overnight.

What to Look For in an Accounting Workflow Software

You don’t need fancy tools to build a strong accounting workflow, but the right software solution can save your team hours each week, and cut down on stress.

Whether you’re running a large firm or you’re a solo accountant, good accounting workflow software helps you automate repetitive tasks, assign work, and track every step in one place.

What Accounting Workflow Software Should Do

A great workflow tool should help your firm:

| Goal | What the software should offer |

| Stay organized | A central location for client info, files, and tasks |

| Save time | Automated workflows for recurring work and reminders |

| Improve teamwork | Easy task assignment, comments, and real-time visibility |

| Standardize quality | Built-in templates for standardized processes |

| Support remote teams | Cloud-based access for hybrid or remote staff |

| Boost client service | Tools for sending requests, collecting client data, and following up |

Why It Matters

Firms that use accounting workflow management software are seeing results:

- Up to 80% faster onboarding for new clients

- Better delivery of high-quality work, even during busy seasons

- Happier staff, thanks to fewer manual steps and clearer expectations

Top accounting professionals use tools like Jetpack Workflow, Aero Workflow, or custom systems built into their practice management software. These tools aren’t just helpful, they’re often the reason firm owners are able to grow without burning out.

Extra Tip:

Look for workflow software that connects with your existing tools, like your document management system, tax software, time tracking, or billing platform. That way, you don’t have to jump between tabs to get client work done.

When everything connects, you reduce admin time, keep client records clean, and improve the flow of your entire practice management system.

In short: the best software isn’t the most complex, it’s the one your team will actually use. Start small, test it with one recurring task, and build from there.

Conclusion

Strong accounting workflows don’t need to be complicated. You can start with one process, like client onboarding or recurring monthly tasks, and build from there. As you improve, your firm will see fewer errors, faster turnaround times, and better client satisfaction. Whether you’re using basic checklists or full accounting workflow software, the goal is the same: a smoother, more efficient way to manage your work, your team, and your clients.